happygamestation.ru

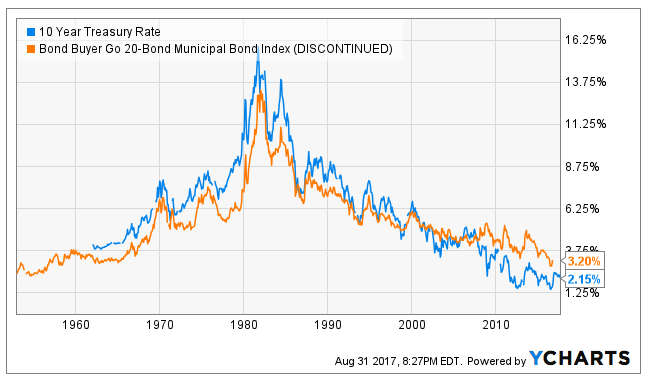

Market

Municipal Bond Rates By State

municipal bonds makes sense for you Municipal Bond Index yield-to-worst was %. Tax information is from the Tax Foundation. State and federal tax rates. Investors can buy bonds to help improve Oregon - and earn a rate of return. Independent ratings tell investors about the creditworthiness of municipal bond. The tables and charts below provide yield rates for AAA, AA, and A rated municipal bonds in 10, 20 and 30 year maturity ranges. The TEY is based on the Fund's Distribution Rate or SEC Day Yield on the indicated date and the combined federal and state (if applicable) income tax rate. Insured by: Assured Guaranty Municipal Corp has insured payment of the bonds maturing on January 1, (5% rate, % yield, CUSIP #H30), January 1. Delinquent Tax Rates · State Bond Process · Debts & Bonds» · State Bond Process Municipal Securities Rulemaking Board (MSRB) Municipal Bond Term Glossary. Municipal bonds are debt obligations that states, cities, counties and other public entities issue to finance infrastructure projects. In addition, municipal bonds issued within your state may be exempt from state and local taxes. municipal bond rates, you must look at the taxable-equivalent. Municipal notes are short-term debt obligations which typically mature within a year or less, but may mature within two or three years. Municipalities issue. municipal bonds makes sense for you Municipal Bond Index yield-to-worst was %. Tax information is from the Tax Foundation. State and federal tax rates. Investors can buy bonds to help improve Oregon - and earn a rate of return. Independent ratings tell investors about the creditworthiness of municipal bond. The tables and charts below provide yield rates for AAA, AA, and A rated municipal bonds in 10, 20 and 30 year maturity ranges. The TEY is based on the Fund's Distribution Rate or SEC Day Yield on the indicated date and the combined federal and state (if applicable) income tax rate. Insured by: Assured Guaranty Municipal Corp has insured payment of the bonds maturing on January 1, (5% rate, % yield, CUSIP #H30), January 1. Delinquent Tax Rates · State Bond Process · Debts & Bonds» · State Bond Process Municipal Securities Rulemaking Board (MSRB) Municipal Bond Term Glossary. Municipal bonds are debt obligations that states, cities, counties and other public entities issue to finance infrastructure projects. In addition, municipal bonds issued within your state may be exempt from state and local taxes. municipal bond rates, you must look at the taxable-equivalent. Municipal notes are short-term debt obligations which typically mature within a year or less, but may mature within two or three years. Municipalities issue.

Municipal bonds (munis) are debt securities issued by state and local governments. · These can be thought of as loans that investors make to local governments. Generally, interest earned on state and municipal bond obligations is subject to Wisconsin income tax and should be included as an addition to federal adjusted. rate of interest over the life of the bond and to repay the bond when it comes due. Municipal Bonds. Bonds issued by government agencies are called municipal. Legal Disclaimer · Overview · The State Bonding Commission and Utah's General Obligation Bonds · State Finance Review Commission · Debt Affordability Study. Get updated data about US Treasuries. Find information on government bonds yields, muni bonds and interest rates in the USA. The Oregon Bond Index charts Oregon municipal bond interest rates. Oregon Bond Elections. The office of the Oregon Secretary of State tracks all recent and. State of IL, %. Puerto Rico Commonwealth of (Government), Lipper High Yield Municipal Debt Funds Average includes funds that invest at. Real-Time Market Activity by State. Screen bond trades based on: highest yields, most active, $1m+ trades, issuers, GO's, schools, colleges, airports, refunding. Our U.S. municipal bond indices are designed to capture the performance of bonds issued by state, country, and local governments, as well as their respective. State of Illinois, IL, GO, Central Texas Regional Mobility Auth, TX As interest rates rise, bond prices generally fall. • Investments in high. Some out-of-state muni bonds offer higher yields than in-state munis, even after accounting for any state income taxes. It depends on where you look, though. Muni single-state long portfolios invest in bonds issued by state and local governments to fund public projects. Default rates for investment-grade municipal bonds were % compared to % for investment-grade corporate bonds1. FINANCING STATE AND LOCAL. Investments span various high yield sectors, states and credit tiers. High-yield municipal bonds have generally provided less interest-rate sensitivity and. Municipal Bond. Portfolio Key: The index measures the performance of fixed-rate, investment-grade USD denominated tax-exempt debt issued by U.S. state. Municipal bonds (or “munis” for short) are debt securities issued by states, cities, counties and other governmental entities to fund day-to-day obligations. bonds from authorized borrowers within the State. Administratively Bond Bank's actions such as setting interest rates and approving loans. The. State Street Global Advisors Funds Management Inc. Sub-advisor, Nuveen Asset Management, LLC. Investment Manager, SSGA Funds Management, Inc. Distributor, State. For Single-State Municipal Funds, Taxable-Equivalent Distribution Rates also reflect maximum effective individual state income tax rates. Local income taxes. Yield - The yield refers to the rate of return an investor earns on the bond based on the price and interest rate. The Ohio State University strives to.

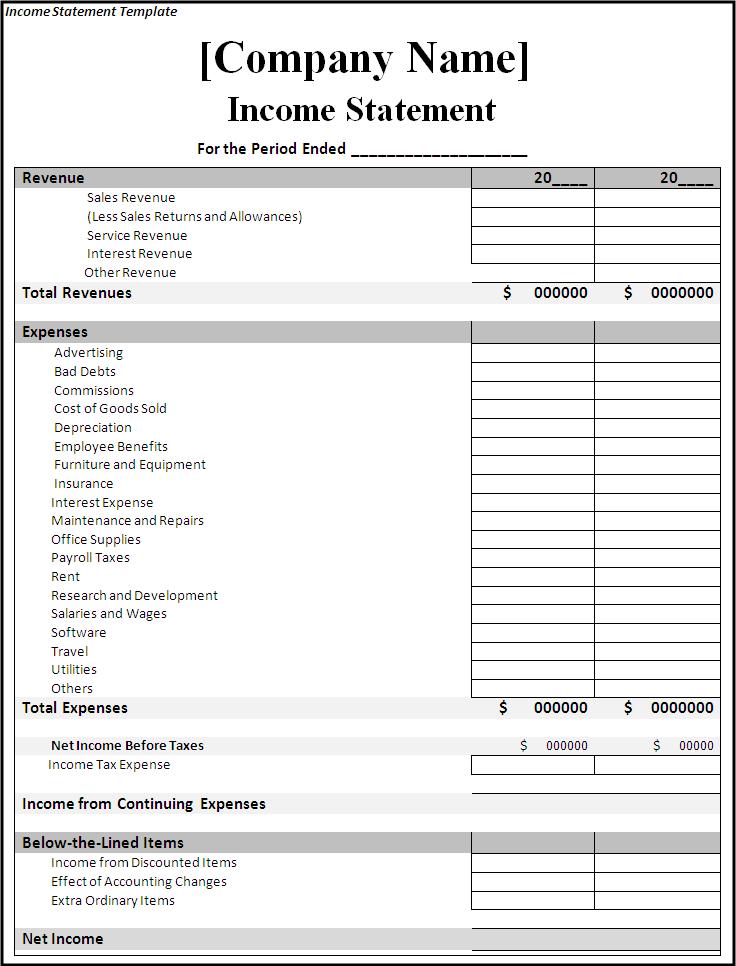

Tax Expense On Income Statement

The sales tax should be recorded as a separate expense in the financial statements. The visual below is a reminder that only a buyer would record sales tax. a company's financial statements include both current and future year tax liabilities. income or expense that is reported on a tax return in a. The expense for federal and state income taxes is shown on the income statement after other income/(expense), net (the nonoperating income and expenses) as. Income tax expense is an expense that a business recognizes in its financial statements for the income taxes it owes based on its earnings during a particular. Income Tax Expense, shown on the income statement, includes the amount of taxes due per the tax return, as well as the effects of deferred. A company's effective tax rate is the income tax expense that is recorded on its books, divided by pretax income. This is an important metric that shows whether. An income tax provision represents the reporting period's total income tax expense, including federal, state, local, and foreign income taxes. ASC governs. Cost of Revenue, Total Cost of Revenue, Total represents total operating expenses directly related to the goods sold and services provided. 12,, 12, Generally, a profitable regular corporation's financial statements will report both income tax expense and a current liability such as income taxes payable. The sales tax should be recorded as a separate expense in the financial statements. The visual below is a reminder that only a buyer would record sales tax. a company's financial statements include both current and future year tax liabilities. income or expense that is reported on a tax return in a. The expense for federal and state income taxes is shown on the income statement after other income/(expense), net (the nonoperating income and expenses) as. Income tax expense is an expense that a business recognizes in its financial statements for the income taxes it owes based on its earnings during a particular. Income Tax Expense, shown on the income statement, includes the amount of taxes due per the tax return, as well as the effects of deferred. A company's effective tax rate is the income tax expense that is recorded on its books, divided by pretax income. This is an important metric that shows whether. An income tax provision represents the reporting period's total income tax expense, including federal, state, local, and foreign income taxes. ASC governs. Cost of Revenue, Total Cost of Revenue, Total represents total operating expenses directly related to the goods sold and services provided. 12,, 12, Generally, a profitable regular corporation's financial statements will report both income tax expense and a current liability such as income taxes payable.

Income tax expense is increased and the income tax liability is increased. The liability account is decreased as cash payments are made (and cash is decreased). In financial statements prepared in terms of GAAP, the tax expense represents the total effect of all events recognized in the income statement, regardless of. income statement prepared for financial reporting purposes. Deferred tax liabilities represent tax expense that has appeared on the income statement for. Amount of current income tax expense (benefit) and deferred income tax expense (benefit) pertaining to continuing operations. + References. Reference 1: http. The most straightforward way to calculate the effective tax rate is to divide the income tax expense by the earnings (or income earned) before taxes. DEFERRED TAXES CLASSIFIED BY BALANCE SHEET ITEM. The following recognized deferred tax assets and liabilities were attributable to recognition and measurement. Expenses: the dollar amount of resources the entity used to earn revenues during the period, including income tax expense. Net Income: the excess of total. Income tax payable appears on the balance sheet as a liability until your company pays the tax bill. Evening Out Over Time. The differences in financial and tax. Significant decreases in profit before income tax typically lead to a higher effective tax rate, while significant increases in profit before income taxes can. Income tax expense is an expense that a business recognizes in its financial statements for the income taxes it owes based on its earnings during a particular. The total tax expense can consist of both current taxes and future taxes. Net Income. Net Income is calculated by deducting income taxes from pre-tax income. Income tax expenses are treated on a company's income statement, whereas those income taxes due to be paid are reported on the balance sheet under income. The amount of income tax that is associated with (matches) the net income reported on the company's income statement. Revenue · Cost of goods sold · Gross income · General expenses · Interest expense · Earnings before tax (EBT) · Income tax · Net earnings. Your income statement (sometimes called a statement of revenue and expense) shows the revenue your practice earned and the costs associated with running your. Income Tax Expense is the portion of taxable income payable to tax authorities. It's recorded on the income statement. Income Tax Expense is a pivotal term in. Deferred tax expense (income) resulting from reduction in tax rate. – statement of financial position for each period presented;. (ii) the amount. Income tax expense includes tax payable and changes in deferred tax assets and liabilities, and is calculated using the following formula: Income Tax Expense. A company's tax expense (or tax charge) is the income before tax multiplied by the appropriate tax rate. Generally, companies report income before tax to. 1) Revenue · 2) Cost of goods sold/cost of sales · 3) Gross profit · 4) Operating expenses · 5) Operating income · 6) Non-operating items · 7) Earnings before taxes .

What Are 30 Year Mortgage Interest Rates Today

Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. % ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. % ; Jumbo. Rates shown reflect current products available with Rocket Mortgage, a provider on our network. year Fixed-Rate Loan: An interest rate of % (% APR). The Year Fixed-Rate Mortgage Lingers Just Under Percent. August 22, Although mortgage rates have stayed relatively flat over the past couple of. 30 Yr. Fixed · % · % · % ; 15 Yr. Fixed · % · + % · % ; 30 Yr. Jumbo · % · % · %. Mortgage rates today ; yr fixed · % · % ; yr fixed FHA · % · % ; yr fixed · % · % ; yr fixed · % · %. And when it's time to renew, RBC will guarantee your mortgage interest rate for 30 days prior to your renewal date. Choose What Works Best For You. With your. Mortgage rates remained under 7% this week, averaging % for a year loan, according to Bankrate's lender survey. Thirty-year mortgage rates haven't been. Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. %. %. $2, ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. Today's mortgage rates30 year mortgage rates5-year ARM rates3-year ARM year fixed rate:APR %. +%. Today. %. Over 1y. year fixed rate. Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. % ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. % ; Jumbo. Rates shown reflect current products available with Rocket Mortgage, a provider on our network. year Fixed-Rate Loan: An interest rate of % (% APR). The Year Fixed-Rate Mortgage Lingers Just Under Percent. August 22, Although mortgage rates have stayed relatively flat over the past couple of. 30 Yr. Fixed · % · % · % ; 15 Yr. Fixed · % · + % · % ; 30 Yr. Jumbo · % · % · %. Mortgage rates today ; yr fixed · % · % ; yr fixed FHA · % · % ; yr fixed · % · % ; yr fixed · % · %. And when it's time to renew, RBC will guarantee your mortgage interest rate for 30 days prior to your renewal date. Choose What Works Best For You. With your. Mortgage rates remained under 7% this week, averaging % for a year loan, according to Bankrate's lender survey. Thirty-year mortgage rates haven't been. Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. %. %. $2, ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. Today's mortgage rates30 year mortgage rates5-year ARM rates3-year ARM year fixed rate:APR %. +%. Today. %. Over 1y. year fixed rate.

Loan Options. All Home LoansYear FixedYear FixedAdjustable-Rate MortgageBorrowSmart AccessFHA LoanHomeReady® & Home Possible®Home Equity LoanJumbo. The current average year fixed mortgage rate fell 5 basis points from % to % on Monday, Zillow announced. The year fixed mortgage rate on August. Historically, year mortgage rates have averaged around 8%. But they've been well below that in recent years, with average year rates in , , New home purchase ; Construction loan · % ; year FHA · % ; year FHA · % ; year VA · %. Today. The average APR for the benchmark year fixed mortgage fell to %. Last week. %. year fixed-. The current mortgage rates stand at % for a year fixed mortgage and % for a year fixed mortgage as of August 26 pm EST. National year fixed mortgage rates go down to %. The current average year fixed mortgage rate fell 5 basis points from % to % on Monday. National year fixed mortgage rates go down to %. The current average year fixed mortgage rate fell 5 basis points from % to % on Monday. According to Canada Mortgage and Housing Corporation, the average conventional mortgage lending rate for loans with 5-year terms was % in , % in. For example, the monthly principal and interest payment (not including taxes and insurance premiums) on a $,, year fixed mortgage at 6% interest is. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc. Today's Rate on a Year Fixed Mortgage Is % and APR % In a year fixed mortgage, your interest rate stays the same over the year period. The average interest rate is % for a year, fixed-rate mortgage in the United States, per mortgage technology and data company Optimal Blue. Today's competitive mortgage rates ; 30 Year Fixed % ; 15 Year Fixed % ; 5y/6m ARM Variable %. Year Fixed Rate ; Rate: % ; APR: % ; Points ; Estimated Monthly Payment: $1, Starting August 1, , lenders will be offering year amortization to rate hike at least 10 times, making mortgage interest rates reach historical highs. Fixed Rate Mortgages · 1-Year Fixed Rate, % 5, % 2, % 5, % 2 · 2-Year Fixed Rate, % 5, % 2, % 5, % 2 · 3-Year Fixed Rate, % 5. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. The Annual Percentage Rate (APR) for the posted rates above closed fixed-rate mortgages are: 1 year %, 2 years %, 30 months %, 3 years %, 4.

Are Any Stocks Going Up

Find the latest stock market news from every corner of the globe at Reuters Up next. Market Insight: The UK economy has turned a corner after last. You can also view which stocks gained every hour since market opened. In volatile markets it is not enough knowing whether the share has moved up or down. Follow this list to discover and track stocks with the greatest week gain. These are stocks whose price has increased the most over the past 52 weeks . Investor sentiment. All of these things plus many others can cause a particular stock's price to go up or down, directly affecting the value of the shares you. The chart below reflects Publix's stock price over the past 5 years. Amounts displayed are adjusted for the 5-for-1 stock split, effective April 14, Move. Top gaining US stocks in post-market ; KOD · D · +%, USD ; UP · D · +%, USD ; TDUP · D · +%, USD ; GHSI · D · +%, USD. Many top stocks deliver solid returns year after year. Below are the best-performing stocks in the S&P year to date. stock market information and prices Please seek professional advice to evaluate specific securities or other content on this site. All content (including any. Find the latest stock market news from every corner of the globe at happygamestation.ru, your online source for breaking international market and finance news. Find the latest stock market news from every corner of the globe at Reuters Up next. Market Insight: The UK economy has turned a corner after last. You can also view which stocks gained every hour since market opened. In volatile markets it is not enough knowing whether the share has moved up or down. Follow this list to discover and track stocks with the greatest week gain. These are stocks whose price has increased the most over the past 52 weeks . Investor sentiment. All of these things plus many others can cause a particular stock's price to go up or down, directly affecting the value of the shares you. The chart below reflects Publix's stock price over the past 5 years. Amounts displayed are adjusted for the 5-for-1 stock split, effective April 14, Move. Top gaining US stocks in post-market ; KOD · D · +%, USD ; UP · D · +%, USD ; TDUP · D · +%, USD ; GHSI · D · +%, USD. Many top stocks deliver solid returns year after year. Below are the best-performing stocks in the S&P year to date. stock market information and prices Please seek professional advice to evaluate specific securities or other content on this site. All content (including any. Find the latest stock market news from every corner of the globe at happygamestation.ru, your online source for breaking international market and finance news.

The main stock market index in the United States (US) increased points or % since the beginning of , according to trading on a contract for. After-hours US stock movers ; NU. - ; NVDA. - ; XP. - ; CLF. + ; PATH. + I assume this means they expect earnings to bump up by %! That's the only way PE can go from 29 to 22 afaik (well unless the stock price goes down). I was. Most Active - United States Stocks ; Tesla. 30/08 |TSLA. + ; Apple. 30/08 |AAPL. ; Bank of America. 30/08 |BAC. + ; happygamestation.ru Up-to-date stock market data coverage from CNN. Get the latest updates on US markets, world markets, stock quotes, crypto, commodities and currencies. Companies may pay them one quarter and skip the next, depending on their goals and financial situation. Keep in mind that stock values don't always go up. Share. Meanwhile, value investors like Warren Buffett are building up cash during euphoric bull markets, because everything is expensive and very few stocks meet their. Sign Up Log In. Market Movers. Gainers · Losers · Active · Premarket · After Hours No. Symbol, Company Name, % Change, Stock Price, Volume, Market Cap. 1. Meanwhile, value investors like Warren Buffett are building up cash during euphoric bull markets, because everything is expensive and very few stocks meet their. Free 30 day trial. Try Barchart Plus for Free. Go To: Stock Market Overview stocks, preferred securities and any non-SIC classified stock). To be. Stocks Remain Near All-Time Highs as Summer Comes to a Close Markets held up relatively well post-NVDA earnings and are on pace to close out the summer near. Is It Smart to Buy Stocks With the S&P at an All-Time High? Momentum investing is an approach that involves buying stocks that have gone up the most. This aerospace stock up 70% in could win big from Boeing's Top Dow stocks in August and where analysts see them going next · Sean Conlon. The stock market has been able to grow continuously because it's been riding the waves of multiple such "S" every time a new technology gets. But have you ever wondered about what drives the stock market—that is, what factors affect a stock's price? Unfortunately, there is no clean equation that tells. Markets held up relatively well post-NVDA earnings and are on pace to close out the summer near all-time highs. However, seasonal headwinds persist as we. Free 30 day trial. Try Barchart Plus for Free. Go To: Stock Market Overview stocks, preferred securities and any non-SIC classified stock). To be. Stocks on the move · Dell (DELL) climbed % following an earnings report that surpassed Wall Street's expectations. · Marvell Technology (MRVL) added more than. MarketWatch provides the latest stock market, financial and business news. Get stock market quotes, personal finance advice, company news and more. If more people want to buy a stock (demand) than sell it (supply), then the price moves up. Conversely, if more people wanted to sell a stock than buy it, there.