happygamestation.ru

Learn

Ways To Earn Money With Crypto

Best Way to Make Money with Crypto: Investing in Presales & New Coins Early · 1. Pepe Unchained – New Ethereum Layer-2 Project for the Pepe Ecosystem · 2. Invest in a rental property. Investing your crypto earnings in rental properties is another lucrative way to earn income from your trading profits. With the. The trick to making money in crypto is to start out your journey by having a lot of money. Then you can slowly start making money in crypto! happygamestation.ru: How to make Money Online With Crypto: Mastering Cryptocurrency, Bitcoin, Blockchain, NFTs, DeFi, Altcoins, & Other Digital Assets. There are several ways to generate passive income with cryptocurrency, including yield-farming through lending or providing liquidity on defi platforms. Earning free crypto by watching videos is another way to get some cryptocurrency into your wallet. Decide which coins you want to get, choose the platform and. You can start earning passive income from cryptocurrency — even if you're a beginner! Interest rewards are one of the easiest ways to start earning passive. Can I make more than one allocation for Crypto Earn? ; Cardholder CRO Stake or CRO Lockup. Maximum. (USD equivalent) ; Equivalent to USD $, $2 Learn more about the numerous ways to make money with cryptocurrency; from staking, lending, investing in startups and more. Best Way to Make Money with Crypto: Investing in Presales & New Coins Early · 1. Pepe Unchained – New Ethereum Layer-2 Project for the Pepe Ecosystem · 2. Invest in a rental property. Investing your crypto earnings in rental properties is another lucrative way to earn income from your trading profits. With the. The trick to making money in crypto is to start out your journey by having a lot of money. Then you can slowly start making money in crypto! happygamestation.ru: How to make Money Online With Crypto: Mastering Cryptocurrency, Bitcoin, Blockchain, NFTs, DeFi, Altcoins, & Other Digital Assets. There are several ways to generate passive income with cryptocurrency, including yield-farming through lending or providing liquidity on defi platforms. Earning free crypto by watching videos is another way to get some cryptocurrency into your wallet. Decide which coins you want to get, choose the platform and. You can start earning passive income from cryptocurrency — even if you're a beginner! Interest rewards are one of the easiest ways to start earning passive. Can I make more than one allocation for Crypto Earn? ; Cardholder CRO Stake or CRO Lockup. Maximum. (USD equivalent) ; Equivalent to USD $, $2 Learn more about the numerous ways to make money with cryptocurrency; from staking, lending, investing in startups and more.

Nano is described as a lightweight cryptocurrency offering near instant payments with no fees. You can earn Nano by completing microtasks - such as completing. How can I make money with Bitcoin? · Buy and Hold (HODL): Many investors buy Bitcoin with the expectation that its price will increase over time. · Trading. The fastest way to earn crypto is by completing simple tasks online through crypto microtasks platforms. These platforms offer you some crypto payments in. Turn your spare time into crypto earnings. Play games, take surveys, and complete other simple microtasks to get paid with $JMPT. Start Earning. The most common way to make money with crypto is through mining. Mining verifies transactions on the blockchain and adds new blocks of data to the chain. By. How to earn passive income from crypto · PoS staking · Crypto interest-bearing platforms · Liquidity provision · Lending crypto · Yield farming · Dividend. Are you looking to make money or earn cash online? Do you want to earn rewards by playing games on your phone? Get ready to play a revolutionary app that. Buy and Hold. By far the most common method for how to earn money with Bitcoin, you buy some Bitcoin and hold it until the market prices. Be patient because you. 4 Easy Ways To Earn Free Crypto. Watch TV. Answer Surveys. Do Offers. Download Apps. Convert Your Points to. Any of these Crypto Currencies. All Crypto orders. If you are interested in making money faster with cryptocurrency, then you should try crypto day trading. It involves buying and selling orders multiple times. The easiest way to start generating crypto rewards on Coinbase is through Coinbase Earn. In exchange for learning the basics about certain cryptocurrencies . Mining is one of the oldest methods of making money with cryptocurrency. It involves using specialized computer hardware to solve complex mathematical puzzles. How can I profit from Bitcoin and Ethereum? HODLing: Hold onto Bitcoin (BTC) and Ethereum (ETH) for the long term, anticipating their value to increase over. 1. Track Your Portfolio Regularly: Check the health of your portfolio frequently, including the amount of cryptocurrency you hold, its current. Passive income in cryptocurrencies is earning money on digital assets without active, day-to-day participation. It involves various methods, such as staking. The best way to make money with cryptocurrency varies based on individual risk tolerance and expertise. Some common methods include trading. Discover how specific cryptocurrencies work — and get a bit of each crypto to try out for yourself. Start earning. NEAR Protocol. NEAR. How can someone invest in bitcoin? As bitcoin has grown in popularity, so have the investment options. One of the ways investors can invest directly in bitcoin. How To Make Money From Cryptocurrency | 10 Best Ways in · 1. Investing. One of the most popular strategies in making money with cryptocurrency is investing. One way to earn crypto through credit cards is by using a credit card that offers rewards or cashback in the form of cryptocurrency. Several credit card.

Net Capital Investment

This account is operated by Netcapital Systems LLC. Netcapital is a new way for friends, family, and customers to invest in companies—and for companies to. Net capital outflow (NCO) is the net flow of funds being invested abroad by a country during a certain period of time (usually a year). A positive NCO means. Net investment is the total amount of funds that are spent by a company to purchase capital assets, less the associated depreciation of the assets. The net. net liquid assets in the customer's account, equal or exceed the investment asset for net capital purposes, its clearing agreement must include such clause. NetCapital does not charge $ to speak to their team. You are intentionally misrepresenting that which speaks to your own credibility. Fiscal balance (or net lending/borrowing) is the net operating balance less net capital investment. Net worth is calculated as total assets minus total. happygamestation.ru's online private investment platform allows companies to close capital digitally and provides investor access to new investment opportunities. Netcapital is a new way for friends, family, and customers to invest in companies—and for companies to raise money by building communities. *. Adjusted Net Capital Expenditures = Net Capital Expenditures + Current year's R&D Any investment in this measure of working capital ties up cash. This account is operated by Netcapital Systems LLC. Netcapital is a new way for friends, family, and customers to invest in companies—and for companies to. Net capital outflow (NCO) is the net flow of funds being invested abroad by a country during a certain period of time (usually a year). A positive NCO means. Net investment is the total amount of funds that are spent by a company to purchase capital assets, less the associated depreciation of the assets. The net. net liquid assets in the customer's account, equal or exceed the investment asset for net capital purposes, its clearing agreement must include such clause. NetCapital does not charge $ to speak to their team. You are intentionally misrepresenting that which speaks to your own credibility. Fiscal balance (or net lending/borrowing) is the net operating balance less net capital investment. Net worth is calculated as total assets minus total. happygamestation.ru's online private investment platform allows companies to close capital digitally and provides investor access to new investment opportunities. Netcapital is a new way for friends, family, and customers to invest in companies—and for companies to raise money by building communities. *. Adjusted Net Capital Expenditures = Net Capital Expenditures + Current year's R&D Any investment in this measure of working capital ties up cash.

Backed by Israeli family offices, we are a highly strategic investment firm looking to invest in transformative, disruptive technologies that are solving. NetCapital does not charge $ to speak to their team. You are intentionally misrepresenting that which speaks to your own credibility. Overall, Netcapital Inc stock has a Value Grade of B, Growth Grade of C,. Whether or not you should buy Netcapital Inc stock will ultimately depend on your. Net CapEx can be calculated either directly or indirectly. In the direct approach, an analyst must add up all of the individual items that make up the total. Capital investment is the acquisition of physical assets by a company for use in furthering its long-term business goals and objectives. Net Capital Expenditure: total expenditure on the purchase of fixed assets less funding raised specifically for their purchase. More Definitions of Net Capital. Backed by Israeli family offices, we are a highly strategic investment firm looking to invest in transformative, disruptive technologies that are solving. Exchange Act Rule 15c (Net Capital Rule) requires that firms must at all times have and maintain net capital at specific levels to protect customers and. Netcapital enables investors to invest in entrepreneurs seeking to raise capital using technology. Netcapital is a new way for friends, family, and customers to invest in companies—and for companies to raise money by building communities. *. Netcapital enables investors to invest in entrepreneurs seeking to raise capital using technology. The company makes private transactions transparent and. This Statement presents estimates of Australian Government general government sector expenses and net capital investment, disaggregated into various functions. Netcapital Inc is a financial technology company. The company facilitates the growth of private companies by providing fundraising services and other consulting. net liquid assets in the customer's account, equal or exceed the investment asset for net capital purposes, its clearing agreement must include such clause. capital online and provides private equity investment opportunities to investors in the United States. The company offers happygamestation.ru, an SEC-registered. Invest, trade, and raise capital using the Netcapital platform. · Gain access to early-stage investment opportunities · Trade private securities · Raise capital. View today's Netcapital Inc stock price and latest NCPL news and analysis. Create real-time notifications to follow any changes in the live stock price. Fiscal balance (or net lending/borrowing) is the net operating balance less net capital investment. Net worth is calculated as total assets minus total. (c) For purposes of this rule, the term "net capital," shall mean assets minus liabilities, as determined by United States generally accepted accounting. (c) For purposes of this rule, the term "net capital," shall mean assets minus liabilities, as determined by United States generally accepted accounting.

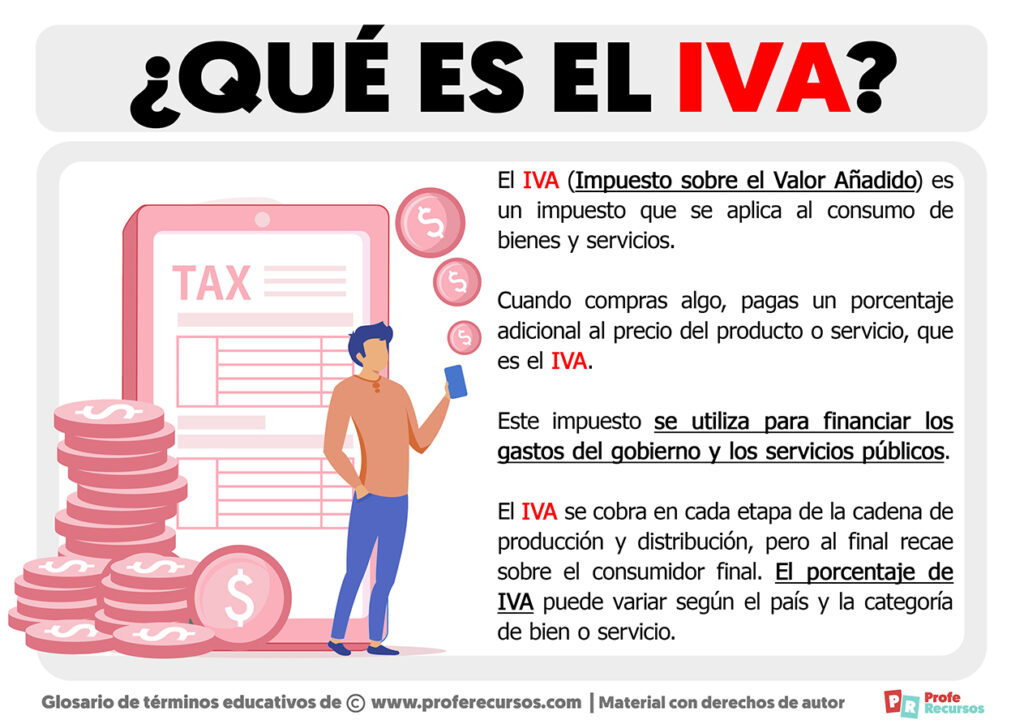

What Is An Iva

Individual Voluntary Arrangement (IVA). An IVA is a formal agreement between you and the people you owe money to. They are also known as your creditors. An IVA is a formal agreement between an individual and their creditors that will combine unaffordable debt repayments into one affordable monthly payment. An individual voluntary arrangement (IVA) is a way to pay off your debts at an affordable rate. It is legally binding agreement between you and the people you. If you're struggling to pay off your debts, you may have heard about Individual Voluntary Arrangements – or IVAs; but what is an IVA exactly? Simply put, IVAs. An IVA is a legally-binding contract between an individual and his or her creditors. An IVA is often regarded as the best option for individuals with assets. An IVA is a legally binding agreement with your creditors to pay back your debts at an affordable rate. Most IVAs last for five or six years. After that time. An individual voluntary arrangement (IVA) is a way to deal with debt you're struggling to repay. It's an agreement between you and your creditors. An IVA is a legally binding arrangement made between you and your creditors to pay off your debts with a repayment plan that suits your circumstances. Any unpaid parts of the debts that were included in the IVA are written off when the arrangement is completed. An IVA can be set up in a number of different. Individual Voluntary Arrangement (IVA). An IVA is a formal agreement between you and the people you owe money to. They are also known as your creditors. An IVA is a formal agreement between an individual and their creditors that will combine unaffordable debt repayments into one affordable monthly payment. An individual voluntary arrangement (IVA) is a way to pay off your debts at an affordable rate. It is legally binding agreement between you and the people you. If you're struggling to pay off your debts, you may have heard about Individual Voluntary Arrangements – or IVAs; but what is an IVA exactly? Simply put, IVAs. An IVA is a legally-binding contract between an individual and his or her creditors. An IVA is often regarded as the best option for individuals with assets. An IVA is a legally binding agreement with your creditors to pay back your debts at an affordable rate. Most IVAs last for five or six years. After that time. An individual voluntary arrangement (IVA) is a way to deal with debt you're struggling to repay. It's an agreement between you and your creditors. An IVA is a legally binding arrangement made between you and your creditors to pay off your debts with a repayment plan that suits your circumstances. Any unpaid parts of the debts that were included in the IVA are written off when the arrangement is completed. An IVA can be set up in a number of different.

An Individual Voluntary Arrangement known as an IVA is a debt solution that guarantees to freeze interest and stop creditors taking legal action against. An IVA (individual voluntary arrangement) is a formal and legally binding agreement between a debtor and their creditors. IVA Explained · An IVA can write off a large sum of your debt · You only pay back what you can afford · The agreement is legally binding, so your creditors have. The IVA register is actually part of the Individual Insolvency Register, which records various types of insolvency, including DROs and bankruptcy. It is a. An IVA is a legally binding agreement between you and the people you owe money to. This means when you've signed it, it can be difficult for you or your. An IVA is a legally binding arrangement between you and your unsecured creditors. You agree to make a single consolidated affordable monthly repayment. IVA is an abbreviation for Individual Voluntary Arrangement. It was introduced as an alternative to bankruptcy as a way for you to clear problem debts at a rate. How can I check my IVA? The status of your IVA will be recorded on your Credit Report, showing the start date, whether it's active or discharged, which Credit. An IVA is a less severe alternative to bankruptcy allowing you to become free from overwhelming debts by making affordable regular payments. Check these steps to help you decide if an individual voluntary arrangement (IVA) is the best way to deal with your debt problems. An individual voluntary arrangement (IVA) is an agreement between you and your creditors to pay all or part of your debts. Individual Voluntary Arrangement (IVA) is a way to write off debt you can't afford. Use our free debt advice tool to see if you qualify. In an IVA, you propose an affordable repayment plan to your creditors (the people you owe money to), explaining how much you can afford and the reasons why. If. An IVA lasts for 5 years. During this time, you'll make one monthly repayment, which we'll divide up between your creditors. At the end of the IVA, any. An Individual Voluntary Arrangement (IVA) is a legally binding agreement between you and the people you owe money to. The Potential Disadvantages of an IVA · You Can't Use An IVA For Some Unsecured Debt · It Can Impact Your Credit Rating · You'll Have to Put Windfalls Into Your. The Government introduced individual Voluntary Arrangements (IVA) in as an alternative to bankruptcy. The process provides a formal structure based on. An IVA is a formal agreement between an individual and their creditors that will combine unaffordable debt repayments into one affordable monthly payment. An individual voluntary arrangement (IVA) is a formal alternative in England and Wales for individuals wishing to avoid bankruptcy.

Webull Account Type

Margin is not available in all account types. Margin trading privileges are subject to Webull Financial, LLC review and approval. Leverage carries a high level. Investment Options: They depend on your account provider, but generally you can invest in stocks, bonds, ETFs, mutual funds, and CDs. Like other types of Roth. I'm a beginner to stocks and trading and I'm signing up for Webull, which is better to start with a Margin or Cash Account? Types of Webull Accounts · Cash account. Unlike the margin account, you've got to pay the full amount for the stocks or other assets that you've bought with your. We do not support switching IRA account types. You can close your current account and then create a new account. For example, a customer can have a margin account and a cash-type account. When does Webull stock market open? Trade with Webull before and standard market. Access Webull cash management to earn a % APY on uninvested cash in your Webull account. No need to open a new account. No fees attached. WBUK acts as your agent in the conduct of business, and will open an account for you with Webull Securities (Australia) Pty. type of order, market conditions. You can login Webull APP -> Menu-> Settings->Manage Account-> Account Type-> Apply to change account typeIt usually takes trading days to cha. Margin is not available in all account types. Margin trading privileges are subject to Webull Financial, LLC review and approval. Leverage carries a high level. Investment Options: They depend on your account provider, but generally you can invest in stocks, bonds, ETFs, mutual funds, and CDs. Like other types of Roth. I'm a beginner to stocks and trading and I'm signing up for Webull, which is better to start with a Margin or Cash Account? Types of Webull Accounts · Cash account. Unlike the margin account, you've got to pay the full amount for the stocks or other assets that you've bought with your. We do not support switching IRA account types. You can close your current account and then create a new account. For example, a customer can have a margin account and a cash-type account. When does Webull stock market open? Trade with Webull before and standard market. Access Webull cash management to earn a % APY on uninvested cash in your Webull account. No need to open a new account. No fees attached. WBUK acts as your agent in the conduct of business, and will open an account for you with Webull Securities (Australia) Pty. type of order, market conditions. You can login Webull APP -> Menu-> Settings->Manage Account-> Account Type-> Apply to change account typeIt usually takes trading days to cha.

Does Webull Offer Instant Deposit? · Instant Buying Power: When you initiate a deposit into your Webull account, the platform grants you instant. Webull Securities (Canada) Limited. November 15, Type: Types of Investments and Types of Accounts · Glossary of Common Investing Terms. Available accounts: Pay attention to the account types each brokerage offers. TD Ameritrade offers more account types, but Webull still gives you access to. Investment Options: They depend on your account provider, but generally you can invest in stocks, bonds, ETFs, mutual funds, and CDs. Like other types of Roth. Free trading of stocks, ETFs, and options refers to $0 commissions for Webull Financial LLC self-directed individual cash or margin brokerage accounts and IRAs. Trading penny stocks on Webull involves using various account types and utilizing the platform's tools to make informed decisions. Both cash and margin. You can choose what type of Webull brokerage account you want: a cash account or a margin account. Margin brokerage accounts let you borrow money against your. Webull Financial, LLC is a CFTC registered Futures Commission Merchant and NFA Member. Futures and futures options trading involves substantial risk and is not. Webull and Bakkt are separate entities. As a customer of both Webull and Bakkt, you have an account at Bakkt to manage your cryptocurrencies. Cryptocurrency. Trade Stocks, ETFs and Options on Webull! Open a Webull brokerage account and receive ONE (1) free stock! type in how much I want to deposit. Open a Webull brokerage account. · When choosing an account type, select Margin. · Fund your account with at least $2, in cash or transfer the equivalent. Webull Financial, LLC is a CFTC registered Futures Commission Merchant and NFA Member. Futures and futures options trading involves substantial risk and is not. WBUK acts as your agent in the conduct of business, and will open an account for you with Webull Securities (Australia) Pty. type of order, market conditions. What types of accounts does webull support?Webull supports two types of individual accounts: cash and margin. Each user can have one of each. A transfer is moving money from one account into another. At Vanguard, you can do 2 types of transfers: External transfers: Asset movements between an IRA or. All you need is the name of the firm holding your account(s) and your account number. Step. 2. Decide what to transfer. Access Webull cash management to earn high for your Webull account. Interest will be paid every month. No need to open a new account. No fees attached. Available accounts: Pay attention to the account types each brokerage offers. TD Ameritrade offers more account types, but Webull still gives you access to. We make it easy to transfer all or part of an account to Fidelity—including stocks, bonds, mutual funds, and other security types—without needing to sell your. For investors with a current Webull account, please open the Webull app and Type 1 Licence for Dealing in Securities, Type 2 Licence for Dealing in.

How To Get Involved In Property Investment

How to invest in property · Assess whether to go ahead with investing in property. Property investment is a big decision. · Consider the risks of investing in. The investment usually also involves the ownership and management of the property, as well as the rental or sale of it, depending on whether you choose buy-to-. Make sure the rents and budget make sense. We manage a variety of homes and apartments that the owners all have various money practices. Proper and beforehand research is a way to go in any type of investment. So is the case with property – there is a huge risk involved in real estate as the. Diversification is a fundamental principle in investment, and it holds true for real estate portfolios as well. Spreading your investments across different. In comparison to other investment options, rental property investing requires you to be actively involved in the process. You should, though, think about. It's often smart to enlist the services of a real estate agent who specializes in purchasing investment property. They will bring specialized knowledge and. Once you find financing and purchase your first property, you have the beginnings of a real estate investment company. Of course, no matter how you. There are several ways to obtain money to invest in property, including savings, mortgage loans, equity release, and private lenders. Savings: Use your savings. How to invest in property · Assess whether to go ahead with investing in property. Property investment is a big decision. · Consider the risks of investing in. The investment usually also involves the ownership and management of the property, as well as the rental or sale of it, depending on whether you choose buy-to-. Make sure the rents and budget make sense. We manage a variety of homes and apartments that the owners all have various money practices. Proper and beforehand research is a way to go in any type of investment. So is the case with property – there is a huge risk involved in real estate as the. Diversification is a fundamental principle in investment, and it holds true for real estate portfolios as well. Spreading your investments across different. In comparison to other investment options, rental property investing requires you to be actively involved in the process. You should, though, think about. It's often smart to enlist the services of a real estate agent who specializes in purchasing investment property. They will bring specialized knowledge and. Once you find financing and purchase your first property, you have the beginnings of a real estate investment company. Of course, no matter how you. There are several ways to obtain money to invest in property, including savings, mortgage loans, equity release, and private lenders. Savings: Use your savings.

What Every Beginner Should Know About Starting A Real Estate Investment · 1. Invest in a Rental Property. save money | investing in real estate · 2. Buy and Flip. Starting in a beginner-friendly investing niche is a great way to learn the ropes before taking on more complex investments. By starting with an accessible. How to Invest in Real Estate ; STEP 1. Open a Self-Directed IRA ; STEP 2. Fund your account ; STEP 3. Find your investment property ; STEP 4. Make an Earnest Money. Real estate agents have access to multiple listing services, which market homes you won't necessarily find on public domains. In addition, using a real estate. There are many ways to get involved in property investment, from buying, redeveloping and selling homes as a small developer to investing in larger property. Buy, Rehab, Rent, Refinance, Repeat (BRRR) is a popular long-term property investment strategy. The strategy entails buying a property, ideally at below market. The initial investment requirements for a real estate fund can significantly differ from those required for direct property investment. As potential investors. How to Invest in Property · Choose Where You Want to Invest · Identify Your Target Tenant · Make Sure Rental Returns are Competitive · Look for Opportunities to Add. Instead, they can be used by regular people as a means of gaining financial happygamestation.ru of us have already realized that investing in real estate can be highly. Many new investors wonder, how much money do you need to invest in real estate? Learn how you can get started investing in real estate today. One of the number one tips on how to start investing in property is to enlist the help of a property investment company. Buying property through a company is a. If your job or other obligations are demanding, you'd be wise to work with a management company that can offer guidance regarding how to buy an investment. Avoid buying property with your friends. It will never workout in the long run (I.e.: misfortune occurring with one of your friend and will. Real estate investment trusts (REITs) are a popular way to invest in real estate. A REIT is a company that owns, operates, or finances income-generating real. Crowdfunding Real Estate investing can be very passive as well. But the due diligence you should do is more involved than simply buying shares of a mutual fund. In comparison to other investment options, rental property investing requires you to be actively involved in the process. You should, though, think about. Consider investing in an affordable single-family home or duplex first. Keep your investment small so you can net returns faster from the rental income or sale. Purchasing and renovating an underperforming property is another common investment strategy. It typically requires a few years to turn the property around, but. The rental income will be an excellent supplement to the commissions you get as a real estate broker. Furthermore, as a broker, you know the local market well. What are my investment options? · Rental properties. · REITs. · Real estate investment groups. · Flipping houses. · Real estate limited partnerships. · Real estate.

Chip And Pin Technology

A chip card provides increased protection against counterfeit, lost and stolen card fraud. For you, chip will mean entering a PIN at chip-reading terminals for. In most countries, authorizing the purchase requires a personal identification number (PIN) that only the user knows. This chip-and-PIN technology exists in the. Chip & PIN technology aims to reduce credit card fraud for card-present transactions. Card-present transactions are those made in person at a store with a. A chip card has a microchip embedded on the front as shown on the card on the left. Chip technology on your card may vary by card issuer. Please refer to. Credit card chip technology is supposed to eliminate nearly any possibility of a data breach, and is much more secure than the current technology, which. A chip and PIN card machine reads this information and asks the user to enter their secret 4-digit PIN (personal identification number), which allows the. The new way · You place your card into the machine that reads the chip · While the card is still in the machine, you enter your pin number · The smart card . To make sure chips in credit cards could actually be read by different card readers across the world, a global standard for chip technology was developed by. The Rise of EMV Technology Enter EMV technology, better known as the “chip card.” Because these cards store data in a computer chip embedded in the card. A chip card provides increased protection against counterfeit, lost and stolen card fraud. For you, chip will mean entering a PIN at chip-reading terminals for. In most countries, authorizing the purchase requires a personal identification number (PIN) that only the user knows. This chip-and-PIN technology exists in the. Chip & PIN technology aims to reduce credit card fraud for card-present transactions. Card-present transactions are those made in person at a store with a. A chip card has a microchip embedded on the front as shown on the card on the left. Chip technology on your card may vary by card issuer. Please refer to. Credit card chip technology is supposed to eliminate nearly any possibility of a data breach, and is much more secure than the current technology, which. A chip and PIN card machine reads this information and asks the user to enter their secret 4-digit PIN (personal identification number), which allows the. The new way · You place your card into the machine that reads the chip · While the card is still in the machine, you enter your pin number · The smart card . To make sure chips in credit cards could actually be read by different card readers across the world, a global standard for chip technology was developed by. The Rise of EMV Technology Enter EMV technology, better known as the “chip card.” Because these cards store data in a computer chip embedded in the card.

Define Chip and PIN Technology. means a Card that contains data embedded in a microchip and requires the Cardholder to enter a personal identification. EMV chip cards use embedded technology to help secure debit and credit cards against fraud. Learn more. These devices are equipped with technology to read cards embedded with a microchip, and this method offers a higher level of security compared to traditional. PIN stands for Personal Identity Number. Credit and Debit cards now include 'Chip and PIN' technology. This means there is a microchip embedded within the card. Chip-and-PIN technology is a secure method to store and exchange sensitive credit card and debit card account data between merchants and their customers. were no longer the most secure option, so a card with a microchip was developed and chip-and-pin EMV cards were rolled out in Europe. These debit and credit. Chip and PIN Technology. Page 2. Welcome to Chip and PIN. Your Bank of America Merrill Lynch card is now. Chip & PIN enabled. The embedded microchip provides. were no longer the most secure option, so a card with a microchip was developed and chip-and-pin EMV cards were rolled out in Europe. These debit and credit. Credit card chip technology is supposed to eliminate nearly any possibility of a data breach, and is much more secure than the current technology, which. With chip and PIN cards, the credit card data is stored on a tiny computer chip — not a magnetic stripe — and customers punch in a four-digit PIN. Chip-and-pin technology may help prevent credit card fraud. Learn what this technology is and how it works to keep your data safe. The debit card requires a PIN to be input in order to process. That's how the chip-and-PIN will work. For a credit card, the card is supposed to be verified by. The effort to move to EMV technology, which is poised to become the global standard for POS and ATM sales, is steered by the world's major payment card. Chip cards are standard bank cards that are embedded with a micro computer chip. Some may require a PIN instead of a signature to complete the transaction. EMV Chip and PIN technology has been in use around the world since Globally in , roughly % of credit cards were EMV chip based. Because the. There may be a PIN required rather than a signature, a possible inconvenience, but most smart cards will continue to require a signature. Conclusion. The. Most debit cards in the U.S. generally use chip and pin EMV tech, while credit cards tend to utilize chip and signature EMV technology, although this isn't a. Chip-and-PIN is the most secure type of credit card technology. Instead of a signature being used for identity verification, it requires you to enter a four-. Chip technology is an international security standard for in-store purchases and ATM transactions.

Best Insurance For First Time Car Owners

The best cheap car insurance for new drivers comes from Geico. According to our research, it not only offers below-average premiums to teen drivers, but also. Auto Insurance That Fits Your Life · Loan/Lease Payoff Coverage · Roadside Assistance · Rideshare Coverage · New Vehicle Replacement Coverage · Accident Forgiveness. Call a local independent agent who can shop your policy across many different insurers and help you choose the right coverages for your situation. How much insurance is enough? What are the top companies in your state? What is gap insurance and do you need it? Everything you need to know. A survey showed that our members saved an average of $ per year when they switched to USAA Auto happygamestation.ru note6. Claims Made Easier. The USAA Mobile App. Cheapest Car Insurance in Chicago for Teen Drivers: Country Financial Country Financial has the lowest car insurance rates for year-old drivers, with an. Nationwide and Travelers are the best overall car insurance providers for first-time drivers, offering a blend of affordability and robust coverage. Auto-Owners, Travelers and Geico offer some of the cheapest insurance for young adults. Young drivers may be able to save on their premiums by shopping around. From car insurance questions about how to get an auto discount to how much coverage do you need, we break down getting car insurance for the first time. The best cheap car insurance for new drivers comes from Geico. According to our research, it not only offers below-average premiums to teen drivers, but also. Auto Insurance That Fits Your Life · Loan/Lease Payoff Coverage · Roadside Assistance · Rideshare Coverage · New Vehicle Replacement Coverage · Accident Forgiveness. Call a local independent agent who can shop your policy across many different insurers and help you choose the right coverages for your situation. How much insurance is enough? What are the top companies in your state? What is gap insurance and do you need it? Everything you need to know. A survey showed that our members saved an average of $ per year when they switched to USAA Auto happygamestation.ru note6. Claims Made Easier. The USAA Mobile App. Cheapest Car Insurance in Chicago for Teen Drivers: Country Financial Country Financial has the lowest car insurance rates for year-old drivers, with an. Nationwide and Travelers are the best overall car insurance providers for first-time drivers, offering a blend of affordability and robust coverage. Auto-Owners, Travelers and Geico offer some of the cheapest insurance for young adults. Young drivers may be able to save on their premiums by shopping around. From car insurance questions about how to get an auto discount to how much coverage do you need, we break down getting car insurance for the first time.

1. USAA. USAA offers the most affordable rates when it comes to standard coverage from a well-known name in insurance. · 2. Travelers. For drivers who aren't. First time car owner? Learn these simple tips and suggestions for insuring Need help figuring out which car insurance discounts are best suited for you? Again, you'll want to check with your insurance agent to determine how you are covered and what your auto policy limits are. It might be a good time to. car, is the new car covered automatically by my auto insurance policy? Does my liability insurance cover me for liability while I am using my vehicle in. The cheapest car insurance companies for first-time drivers are Travelers, USAA, and Geico, according to WalletHub's analysis. A new kind of car insurance. We use location-based technology to make your insurance better and more affordable. Super fast claims resolution. Nationwide has the best car insurance for teens, according to our analysis of rates, policy coverages and features, customer complaints and collision repairs. As a general rule, in the US, your cheapest insurance companies will be The General and SafeAuto. I'm not sure I would trust either of those. A new kind of car insurance. We use location-based technology to make your insurance better and more affordable. Super fast claims resolution. A survey showed that our members saved an average of $ per year when they switched to USAA Auto happygamestation.ru note6. Claims Made Easier. The USAA Mobile App. The Zebra's experts consider State Farm, USAA, and Nationwide the best insurance companies for new drivers thanks to their cheap rates, wide availability, and. Age alone doesn't determine car insurance premiums. There are ways to keep costs down, too, regardless of whether you're a young or new driver. For instance. What Are the Best Insurance Companies for New Drivers? · GEICO. Considered one of the most affordable companies, a six-month premium for a year-old male. When shopping for car insurance for the first time, you'll likely try to find a balance between sufficient coverage and an affordable premium. How to Locate Best Insurance For First Time Car Owners The best way to obtain car insurance is to be added onto an existing policy. Usually, someone in your. These tips will help you proceed as a first-time car buyer. 1. Think about Related topics & resources. Get the best car insurance rate · How does gap. Insurance for new drivers and teen drivers from State Farm may be more affordable than you think. Find out which discounts you qualify for by contacting an. new policies, on all persons they insure for motor vehicle insurance. This Failure to maintain liability insurance coverage for your car at all times. New Teen Driver Discount. Offers a discount when you add a new teenage driver to your policy within the past year. · Teen Driving Program Discount · Good Student. Mercury provides cheap auto insurance without compromising on quality. Learn more about our cheap auto insurance policies in New York.

Healthlynked Stock

![]()

Our HealthLynked products provide a proprietary cloud-based platform that allows members to connect with their healthcare providers. HealthLynked Corp. stock grades by Barron's. View HLYK fundamental and sentiment analysis powered by MarketGrader. Key Stats · Market CapM · Shares OutM · 10 Day Average Volume, · Dividend- · Dividend Yield- · Beta · YTD % Change Information on stock, financials, earnings, subsidiaries, investors, and executives for HealthLynked. Use the PitchBook Platform to explore the full. Stock analysis for HealthLynked Corp (D:US) including stock price, stock chart, company news, key statistics, fundamentals and company profile. In depth view into HLYK (HealthLynked) stock including the latest price, news, dividend history, earnings information and financials. The week high for HealthLynked Corp. Stock is $ and the week low is $ Get the latest stock price for HealthLynked Corp (HLYK:US), plus the latest news, recent trades, charting, insider activity, and analyst ratings. HealthLynked Corp. ; Market Value, $M ; Shares Outstanding, M ; EPS (TTM), -$ ; P/E Ratio (TTM), N/A ; Dividend Yield, N/A. Our HealthLynked products provide a proprietary cloud-based platform that allows members to connect with their healthcare providers. HealthLynked Corp. stock grades by Barron's. View HLYK fundamental and sentiment analysis powered by MarketGrader. Key Stats · Market CapM · Shares OutM · 10 Day Average Volume, · Dividend- · Dividend Yield- · Beta · YTD % Change Information on stock, financials, earnings, subsidiaries, investors, and executives for HealthLynked. Use the PitchBook Platform to explore the full. Stock analysis for HealthLynked Corp (D:US) including stock price, stock chart, company news, key statistics, fundamentals and company profile. In depth view into HLYK (HealthLynked) stock including the latest price, news, dividend history, earnings information and financials. The week high for HealthLynked Corp. Stock is $ and the week low is $ Get the latest stock price for HealthLynked Corp (HLYK:US), plus the latest news, recent trades, charting, insider activity, and analyst ratings. HealthLynked Corp. ; Market Value, $M ; Shares Outstanding, M ; EPS (TTM), -$ ; P/E Ratio (TTM), N/A ; Dividend Yield, N/A.

Profile Summary. HealthLynked Corp. operates through three division: the Health Services Division, the Digital Healthcare Division, and the Medical. HealthLynked Corp. company facts, information and financial ratios from MarketWatch Real-time last sale data for U.S. stock quotes reflect trades reported. HealthLynked Corp (HLYK) advanced chart and technical analysis tool allows you to add studies and indicators such as Moving Averages (SMA and EMA), MACD. Company profile for Healthlynked Corp (HLYK) including business summary, key statistics, ratios, sector. HealthLynked is reshaping the future of global healthcare. We are committed to nurturing a highly interconnected and more efficient healthcare infrastructure. HealthLynked Corp. (HLYK.): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock HealthLynked Corp. Naples, FL – August 12, – HealthLynked Corp. (OTCQB: HLYK), a leader in healthcare technology and patient engagement solutions, is excited to announce. Our HealthLynked products provide a proprietary cloud-based platform that allows members to connect with their healthcare providers. The latest HealthLynked stock prices, stock quotes, news, and HLYK history to help you invest and trade smarter. Stock Information · Stock Chart · Stock Quote · Buy Stock · IR Contacts · Financial Information · Governance · Management · Board of Directors · Medical. HLYK Healthlynked Corp. $ $ (%). Today. Watchers, Wk Low, $ Wk High, $ Market Cap, $M. Volume, 1, Find the latest HealthLynked Corp. (HLYK) stock discussion in Yahoo Finance's forum. Share your opinion and gain insight from other stock traders and. HealthLynked Corp (HLYK) has a Smart Score of N/A based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom. View HEALTHLYNKED CORP (HLYK) stock price, news, historical charts, analyst ratings, financial information and quotes on Moomoo. Trade commission-free with. Unique to happygamestation.ru, Opinions analyzes a stock or commodity using 13 popular analytics in short-, medium- and long-term periods. Results are interpreted as. HealthLynked Corp. provides a solution for both patient members and healthcare providers to improve healthcare through the efficient exchange of medical. Discover real-time HealthLynked Corp (HLYK) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. HealthLynked Stock Forecast: Will HealthLynked Stock Go Up Next Year? Data Unavailable HealthLynked Stock Rating Data Unavailable HealthLynked Stock Price. Stock; HLYK; Overview. HLYK. HealthLynked Corp. Common Stock. %. / ( x ). Real-Time Best Bid & Ask: am 07/17/. HealthLynked Corp. · AT CLOSE PM EDT 07/11/24 · USD · % · Volume,

Business Banking No Monthly Fee

Standout benefits: The Novo Business Checking account doesn't charge monthly maintenance fees and doesn't require a minimum initial deposit to open the account. Totally Free Business Checking. A free account with all the essentials! No minimum balance or monthly service charge. No charge for up to transactions per month based on the combined volume of deposits, deposited items, paid items, and ACH credits and debits received. Ideal for start-ups, independent contractors, and small businesses with lower balance and checking activity. $0. Monthly Maintenance Fee. No monthly maintenance. One extra Business Advantage Relationship Banking account and one Business Advantage Savings account can be included for no monthly fee · No fees for incoming. There is a $15 Monthly Service Fee (MSF) that we'll waive if you meet any of the below qualifying activities for each Chase Business Complete Checking® account. Free Small Business Checking is just one way we do our part. Key Account Details: No monthly service charge; free monthly transactions 1. Convenient. Novo is an online business banking platform with no hidden fees built for small business owners. Apply for a free Novo checking account. Business banking simplified. Online business checking accounts with American Express Business Checking have no monthly maintenance fees or minimum balance. Standout benefits: The Novo Business Checking account doesn't charge monthly maintenance fees and doesn't require a minimum initial deposit to open the account. Totally Free Business Checking. A free account with all the essentials! No minimum balance or monthly service charge. No charge for up to transactions per month based on the combined volume of deposits, deposited items, paid items, and ACH credits and debits received. Ideal for start-ups, independent contractors, and small businesses with lower balance and checking activity. $0. Monthly Maintenance Fee. No monthly maintenance. One extra Business Advantage Relationship Banking account and one Business Advantage Savings account can be included for no monthly fee · No fees for incoming. There is a $15 Monthly Service Fee (MSF) that we'll waive if you meet any of the below qualifying activities for each Chase Business Complete Checking® account. Free Small Business Checking is just one way we do our part. Key Account Details: No monthly service charge; free monthly transactions 1. Convenient. Novo is an online business banking platform with no hidden fees built for small business owners. Apply for a free Novo checking account. Business banking simplified. Online business checking accounts with American Express Business Checking have no monthly maintenance fees or minimum balance.

Nonprofit checking account. Ideal features for nonprofit organizations with unique needs; No monthly maintenance fee and no minimum balance restriction; 1, Our Free Business Checking comes with free transactions and a slew of other benefits, without monthly fees or a required minimum balance. No monthly maintenance fees, no charge on electronic debits and credits, and no foreign transaction fees1. · Free bill payment, and online, mobile2 and telephone. Dollar Bank's Free Business Checking Account has all the features you need to manage your finances, all without a monthly fee or minimum balance. The Truist Simple Business Checking account is straightforward, with no monthly maintenance fee. Perfect if you're just getting started with your business. Free business checking accounts from American Express, Bluevine, Found, Lili, U.S. Bank, NBKC and more offer small businesses banking with no monthly fee. TD Business Simple Checking customers enrolling in Invoicing only, will pay no monthly service fee. Customers with multiple business checking accounts are. Waive the Monthly Service Fee if you maintain a $, combined average beginning day balance · transactions per month at no charge, plus unlimited. No minimum balance and no monthly 1 service charge. Plus, get access to business banking experts for questions large and small. Small Business Checking & Savings ; Entrepreneur Checking · No minimum monthly balance or monthly maintenance fees · free monthly transactions ; Business. Initiate Business Checking · $10 monthly service fee · No transactions fee for the first transactions ; Navigate Business Checking · $25 monthly service fee. A basic account with no monthly maintenance fees - ideal for smaller businesses with modest account activity. Overdraft line of credit1. Yes. Monthly. Best FinTech: Lili: Basic Business Checking Lili Basic, which requires no monthly fees, is light on the benefits but includes a heavy-duty app that'll help. Fee Type: Monthly fee. Fee: $ Pay no monthly fee for Business Advantage Fundamentals™ Banking when you meet one of the following requirements each. Boost your business with our Basic Business Checking account tailored to your ambitions with no initial deposit, no monthly fees, a welcome bonus, and more. No monthly service fee; No minimum balance requirements. Account Features: Up to transactions and up to $5, in cash deposits per month without an. No cash deposit processing fee for the first $5, deposited per fee period. After $5,, it's $ per $ deposited. Transactions fees. No transactions fee. Transactions per Month, No charge for the first transactions debited or credited (deposits, check items deposited, checks cleared, ATM, point of sale and. Business Banking · No minimum balance · No monthly maintenance fee when enrolled in paperless statements · Up to free transactions 2 per month · $5, cash. Fee-free Digital. Unlimited digital transactions each month with no fees in sight. 1.

What Is The Rent To Own Process

Although a lease-to-own or other alternative home purchase agreement may appear to offer a path to homeownership, these agreements may impose harsh terms with. Sign a rent-to-own agreement and pay an option fee. The option fee is usually non-refundable, but can be applied to the purchase price. Pay rent, with a. Rent to own in a nutshell: you agree up front on a purchase price with the owner, but lease for a period of time with typically a portion of the. The rent to own process is actually pretty simple. Once you've seen one of our fantastic properties, we'll give you an application to fill out. Don't worry – we. The rent-to-own home purchase price agreement could require an amortized year collection in one lump sum balloon payment after five years. For example, most. A rent-to-own agreement is a deal in which you commit to renting a property for a specific period of time, with the option of buying it before the lease runs. There are two types of agreements associated with the rent-to-own regime. The first is the option-to-purchase. If this option is chosen, the potential purchaser. Join our property list and tell us what type of home you're looking for, your budget, etc (START with the form to the right) · We'll send you local rent-to-own /. The rent-to-own process allows tenants to build equity in the property while renting it. A portion of the rent paid by the tenant goes towards the equity in the. Although a lease-to-own or other alternative home purchase agreement may appear to offer a path to homeownership, these agreements may impose harsh terms with. Sign a rent-to-own agreement and pay an option fee. The option fee is usually non-refundable, but can be applied to the purchase price. Pay rent, with a. Rent to own in a nutshell: you agree up front on a purchase price with the owner, but lease for a period of time with typically a portion of the. The rent to own process is actually pretty simple. Once you've seen one of our fantastic properties, we'll give you an application to fill out. Don't worry – we. The rent-to-own home purchase price agreement could require an amortized year collection in one lump sum balloon payment after five years. For example, most. A rent-to-own agreement is a deal in which you commit to renting a property for a specific period of time, with the option of buying it before the lease runs. There are two types of agreements associated with the rent-to-own regime. The first is the option-to-purchase. If this option is chosen, the potential purchaser. Join our property list and tell us what type of home you're looking for, your budget, etc (START with the form to the right) · We'll send you local rent-to-own /. The rent-to-own process allows tenants to build equity in the property while renting it. A portion of the rent paid by the tenant goes towards the equity in the.

In most cases, the rental term for a rent-to-own lease is one to three years. The buyer must present funds to pay the seller an upfront payment or option fee. Renting to own is an alternate route to buying or selling a home when traditional home loans are not an option. There are two types of rent-to-own contracts. “Rent-to-own” is another term for a lease option. You rent the property and pay more than the market price for rent. A portion of each payment. For many people, rent-to-own sounds like a simple and practical agreement—live in the house as a tenant, pay rent each month, and have the rent count toward. How does rent to own work? · 1. You sign one of two types of agreements. · 2. You and the landlord set a purchase price. · 3. You pay an option fee. · 4. You decide. The rent-to-own process is pretty much what you might expect. It's a way to give renters a chance to buy real estate, and to live in the property until it's. The Process of Renting to Ownership So what does this whole transaction look like? Here's an overview of the process: Non-refundable option payment. Go with a traditional mortgage of at all possible but if that won't work, a rent to own may be a good option to get into a property. Talk to a. The rent-to-own home purchase price agreement could require an amortized year collection in one lump sum balloon payment after five years. For example, most. In a rent to own agreement or a lease option, an individual rents a home and has the choice to purchase it after a set period, usually between two to five. “Rent-to-own” is another term for a lease option. You rent the property and pay more than the market price for rent. A portion of each payment. What's in the Lease or Rental Agreement In a rent-to-own agreement, the title to the house remains with the landlord until the tenant exercises the option and. A 'Rent to Own' program, also known as a lease-to-own or rent-to-own agreement, is a housing arrangement that combines elements of renting and buying a home. A rent-to-own home gives a renter a path to purchase a home they're renting after their lease ends. Learn how the process works to decide if it's right for. You don't have to qualify for a mortgage immediately: If you need to improve your credit score or pay off debt before you can save up for a down payment, a rent. In a rent to own agreement or a lease option, an individual rents a home and has the choice to purchase it after a set period, usually between two to five. The rent-to-own process starts with you finding the right rent-to-own program to suit your needs. With the help of a licensed agent, you can find the perfect. Rent to own homes are properties in which a buyer is permitted to rent a home for a specified amount of time with the option of purchasing that home during. While rent-to-own terminology is most commonly associated with consumer goods transactions, the term is sometimes used in connection with real estate. For many people, rent-to-own sounds like a simple and practical agreement—live in the house as a tenant, pay rent each month, and have the rent count toward.