happygamestation.ru

Gainers & Losers

Best Crypto Games For Android

There's a growing range of quality crypto games Android users can enjoy. From breeding games and card games to MMORPG games and mining games, there's plenty to. In Splinterlands, players fight against monsters to get in-game rewards from their desktop and mobile phones. Spinterlands is a gaming boss to join crypto. This. Android Games · Browse Android Games · Immortal Rising 2 · Wonder Wars · Hex Mythica · Zeeverse · Xpell · Wreck League · Wonderhero. One of the best P2E blockchain games for creative people is the Sandbox. the sandbox is built as an Ethereum-based open-world game this is the most popular. LandRocker is a play-to-earn game about discovery and space exploration where players compete to uncover valuable resources such as NFTs, crypto tokens. and soon will be released on iOS devices as well. Forest Knight is a play to earn mobile game. powered by Ethereum and Polygon Layer 2. Knight Token price. Top NFT Crypto Mobile Game ; 2. big-time. Big Time. BIGTIME ; 3. clash-of-lilliput. Clash of Lilliput. COL ; 4. GameBuild. GAME ; 5. Karrat. KARRAT. Splinterlands is a collectible crypto card game powered by the Hive blockchain. Under the terms, users collect Rare Monster Cards (NFT) to fight other. Gods Unchained is without a doubt one of the best crypto games, and CoinFantasy is another one that I adore playing on my phone. There's a growing range of quality crypto games Android users can enjoy. From breeding games and card games to MMORPG games and mining games, there's plenty to. In Splinterlands, players fight against monsters to get in-game rewards from their desktop and mobile phones. Spinterlands is a gaming boss to join crypto. This. Android Games · Browse Android Games · Immortal Rising 2 · Wonder Wars · Hex Mythica · Zeeverse · Xpell · Wreck League · Wonderhero. One of the best P2E blockchain games for creative people is the Sandbox. the sandbox is built as an Ethereum-based open-world game this is the most popular. LandRocker is a play-to-earn game about discovery and space exploration where players compete to uncover valuable resources such as NFTs, crypto tokens. and soon will be released on iOS devices as well. Forest Knight is a play to earn mobile game. powered by Ethereum and Polygon Layer 2. Knight Token price. Top NFT Crypto Mobile Game ; 2. big-time. Big Time. BIGTIME ; 3. clash-of-lilliput. Clash of Lilliput. COL ; 4. GameBuild. GAME ; 5. Karrat. KARRAT. Splinterlands is a collectible crypto card game powered by the Hive blockchain. Under the terms, users collect Rare Monster Cards (NFT) to fight other. Gods Unchained is without a doubt one of the best crypto games, and CoinFantasy is another one that I adore playing on my phone.

Gaming crypto coins ; 17 MARBLEX MBX. $ $ M · $ million ; 18 GameBuild GAME. $ $ M · $ million ; 19 XAI XAI. $ $ M. Tap-to-earn projects are mobile games that pay users in crypto to engage in simple tasks. These tasks often include simply tapping the screen. Brilliantcrypto · Game · Roadmap · Partners · Token · White Paper. Socials. Discord For Mobile Devices. Download for Android (英語サイト) (Full Version). Let's Make Money Fun! ; NEW. Ethereum Blast, blast the stone - free Ethereum game. Ethereum Blast. Sci-Fi Puzzle Game ; Most popular. Bitcoin Pop, Bubble shooter. Play to Earn Games List · Axie Infinity · Reward Hunters · Farmers World · Monsta Infinite · Binemon · Devikins · Plant vs Undead · MOBOX. Wolf Game. Mars4. Elfin Kingdom. DeFi Kingdoms. Cardano Warriors. The Wasted Lands. SIDUS Heroes. Ninneko. Pegaxy. Elemon. Codyfight. GameFi merges blockchain technology with gaming, allowing players to earn cryptocurrency and truly own in-game assets through tokenization. Born. Crypto games are online games that are built with blockchain technology. Players of crypto games can earn or win cryptocurrency and digital tokens. According to the report, the best blockchain games are Sky Mavis, Decentraland, Radio Caca, Gala Games, MOBOX, Defi Kingdoms, and Illuvium Labs. Blockchain-. Inspired by Nintendo's Pokémon series, Axie Infinity is a blockchain-based monster battling game. Illuvium Logo Illuvium. Enterprise CustomersWeb3 Games. The Main Agenda – Best Mobile Crypto Games · Axie Infinity (AXS) · The Sandbox (SAND) · CryptoKitties (CK) · Gods Unchained (GODS) · My Crypto Heroes (MCH). Your journey into the ether space begins here! The next iteration in crypto earning games has arrived, this time with an Ethereum theme! Ethereum Blast is a. Top Blockchain Games List ; SoRare, Collectible Sport ; Grit, Action Battle Royale ; Legends of Elumia, MMO RPG ; NBA Top Shot, Collectible. PlayToEarn is the best source to find Play-To-Earn Crypto & NFT Blockchain %. Blockchain Games. Top Android Games. Trending. Gainers. Losers. Genre. 10 Best Crypto NFT Games of · 1. Axie Infinity: Trade-and-Battle with Ethereum-Minted NFTs · 2. Decentraland: Virtual Reality, 3D-World Building · 3. Alien. Super Champs is one of the most popular play-to-earn crypto games available for Android smartphones. It recently launched Season 1 of its play-. Get the best crypto game services · Telegram crypto game, telegram mini game, crypto game · Develop blockchain game crypto game blockchain game crypto · Develop a. Axie Infinity is a groundbreaking blockchain game that revolutionizes the concept of play-to-earn. With its collection, breeding, and battling of digital. The best crypto games to play · Real also – · Built on one of the most prominent blockchain networks, EOS Knights comes with smart contracts that account for. Do you want to mine a little bit? We have this! The Crypto Games: Bitcoin - is a classic idle simulator game about Bitcoin mining.

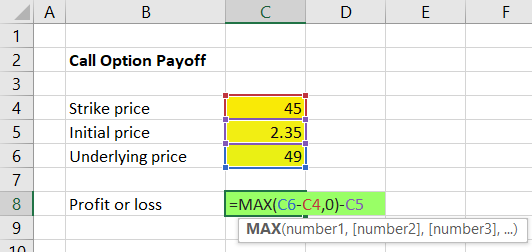

Call Option Premium Calculator

The options calculator is an intuitive and easy-to-use tool for new and seasoned traders alike, powered by Cboe's All Access APIs. Option Type: Call Put. Strike price. Current value of stock/ index. Volatility % pa. Days left to expiration. Option Premium. Using the Black and Scholes option pricing model, this calculator generates theoretical values and option greeks for European call and put options. Options Calculator and press 'enter button' to calculate the option premium. Next, choose whether the option is a Call option or a Put Option. American. Option. Strike. Expiration (years). Stock. Price. Volatility. Dividend European Call, European Put, Forward, Binary Call, Binary Put. Price. Delta. Gamma. It supports both call and put options. Black-Scholes Formula. The Black-Scholes formula is a mathematical model used for calculating the theoretical price of. Call option profit calculator. Visualise the projected P&L of a call option at possible stock prices over time until expiry. You sell both calls and puts with the same expiration and strike, expecting a small move in volatility regardless of direction. You keep the premium but open. Calculate potential profit, max loss, chance of profit, and more for covered call options and over 50 more strategies. The options calculator is an intuitive and easy-to-use tool for new and seasoned traders alike, powered by Cboe's All Access APIs. Option Type: Call Put. Strike price. Current value of stock/ index. Volatility % pa. Days left to expiration. Option Premium. Using the Black and Scholes option pricing model, this calculator generates theoretical values and option greeks for European call and put options. Options Calculator and press 'enter button' to calculate the option premium. Next, choose whether the option is a Call option or a Put Option. American. Option. Strike. Expiration (years). Stock. Price. Volatility. Dividend European Call, European Put, Forward, Binary Call, Binary Put. Price. Delta. Gamma. It supports both call and put options. Black-Scholes Formula. The Black-Scholes formula is a mathematical model used for calculating the theoretical price of. Call option profit calculator. Visualise the projected P&L of a call option at possible stock prices over time until expiry. You sell both calls and puts with the same expiration and strike, expecting a small move in volatility regardless of direction. You keep the premium but open. Calculate potential profit, max loss, chance of profit, and more for covered call options and over 50 more strategies.

option. #6) Call-Selling Calculator. The final spreadsheet does that for covered calls: Call Option Premium Calculator. Platform-Independent and % Unlocked. Our black scholes calculator for determining the value of stock options using the Black-Scholes model. To reduce his vulnerability to time decay, James buys an AAPL $ 20 Jan 23 Call at a premium of with 64 days to expiration. He intends to exit the. You sell both calls and puts with the same expiration and strike, expecting a small move in volatility regardless of direction. You keep the premium but open. Use the TipRanks Options Profit Calculator to estimate your potential profit or loss from an options trade. Simply enter the type of option, strike price. It does not factor in premium costs since premium is determined by the people of the market. This calculator also calculates the value of put options if the. Calculate Option Price using the Option Calculator based on the Black Scholes model Buying Call Options: Use the calculator to determine the potential profit. Goal: To breakeven at expiration, you need for the underlying stock price to be above the strike price plus the premium you paid for the option. Interest Rate: In the Black-Scholes model, a risk-free interest rate is used to calculate the prices of call and put options. AMFI: ARN ;Insurance. premium that must be paid when entering the position. The Option Calculator computes a series of theoretical option prices based on the options selected and. The option price calculator is an arithmetic calculating algorithm, which is used to speculate and it also helps us to analyze options. If the price of the stock rises, the call option premium will tend to rise and the put option premium will decrease, all else being equal. However, the. Buying or selling an option comes with a price called the option's premium. The equations to calculate the intrinsic value of a call or put option are. Black & Scholes Option Pricing Formula. Spot. Strike. Expiry. Volatility (%). Interest (%). Dividend. Calculate. Call Option Premium, Put Option Premium. Register with OIC as Individual Investor, you'll have immediate access to options courses from OCC Learning and our suite of modernized tools and calculators. option price or option premium. The Option Greeks sensitivity measures option (i.e. call option or put option) and accordingly evaluate the output. Theta for Call Option, , , , , 25, Theta for Put Premium, Delta, Theta, Gamma, Vega, Rho. 15, Call option, , , Call Ladder Calculator · Bear Call Spread. Bearish Stable. Intermediate. Credit Spread, Premium Income. Capped Profit. Moderate Risk. Capped Loss. Low Capital. call option writers make profit limited to the premium received by them. The buyer of a Put option has a RIGHT to SELL the underlying at a pre-determined price. it shows the profits as , , , , for a 2/26 call option for example until friday. premiums. Upvote 1. Downvote Reply.

Nomura Stock

On Wednesday, Nomura Holdings Inc (TYO) closed at , % below its week high of 1,, set on Jul 17, Data delayed at least View the latest Nomura Holdings Inc. () stock price, news, historical charts, analyst ratings and financial information from WSJ. Key Data. Open $; Day Range - ; 52 Week Range - ; Market Cap $B; Shares Outstanding B; Public Float B; Beta Looking to buy Nomura Holdings Stock? View today's NMR stock price, trade commission-free, and discuss NMR stock updates with the investor community. Complete Nomura Holdings Inc. stock information by Barron's. View real-time NRSCF stock price and news, along with industry-best analysis. The latest Nomura Holdings stock prices, stock quotes, news, and NRSCF history to help you invest and trade smarter. Stock analysis for Nomura Holdings Inc (Tokyo) including stock price, stock chart, company news, key statistics, fundamentals and company profile. View today's Nomura Holdings Inc ADR stock price and latest NMR news and analysis. Create real-time notifications to follow any changes in the live stock. Key Stats · Market CapB · Shares OutB · 10 Day Average VolumeM · Dividend · Dividend Yield% · Beta · YTD % Change On Wednesday, Nomura Holdings Inc (TYO) closed at , % below its week high of 1,, set on Jul 17, Data delayed at least View the latest Nomura Holdings Inc. () stock price, news, historical charts, analyst ratings and financial information from WSJ. Key Data. Open $; Day Range - ; 52 Week Range - ; Market Cap $B; Shares Outstanding B; Public Float B; Beta Looking to buy Nomura Holdings Stock? View today's NMR stock price, trade commission-free, and discuss NMR stock updates with the investor community. Complete Nomura Holdings Inc. stock information by Barron's. View real-time NRSCF stock price and news, along with industry-best analysis. The latest Nomura Holdings stock prices, stock quotes, news, and NRSCF history to help you invest and trade smarter. Stock analysis for Nomura Holdings Inc (Tokyo) including stock price, stock chart, company news, key statistics, fundamentals and company profile. View today's Nomura Holdings Inc ADR stock price and latest NMR news and analysis. Create real-time notifications to follow any changes in the live stock. Key Stats · Market CapB · Shares OutB · 10 Day Average VolumeM · Dividend · Dividend Yield% · Beta · YTD % Change

Nomura Holdings, Inc.'s revenue estimate for is $B. The latest low revenue estimate is $B and the high revenue estimate is $B. Learn more. Nomura Holdings (NMR) Stock Price & Analysis · Nomura Holdings Stock Smart Score · Nomura Holdings News · Company Description · NMR Company Deck · NMR Earnings Call. Nomura Holdings, Inc. (TYO): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock Nomura Holdings, Inc. | Japan Exchange. Get the latest Nomura Holdings Inc ADR American Depositary Shares (NMR) stock price, news, buy or sell recommendation, and investing advice from Wall Street. Nomura Group IR information including financial information, annual reports, information to our shareholders and corporate governance. The latest Nomura Holdings stock prices, stock quotes, news, and NMR history to help you invest and trade smarter. Discover real-time Nomura Holdings Inc. (NRSCF) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. Get Nomura Holdings Inc (T-JP:Tokyo Stock Exchange) real-time stock quotes, news, price and financial information from CNBC. Nomura Holdings Inc. share price in real-time ( / JP), charts and analyses, news, key data, turnovers, company data. View live NOMURA HOLDINGS INC. chart to track its stock's price action. Find market predictions, financials and market news. Discover real-time Nomura Holdings Inc ADR American Depositary Shares (NMR) stock prices, quotes, historical data, news, and Insights for informed trading. Nomura Holdings website. Group companies, news releases, services, CSR, IR, careers information. Nomura stock price, live market quote, shares value, historical data, intraday chart, earnings per share and news. View Nomura Holdings, Inc. Sponsored ADR NMR stock quote prices, financial information, real-time forecasts, and company news from CNN. Nomura Holdings, Inc. provides various financial services to individuals, corporations, financial institutions, governments, and governmental agencies. | Complete Nomura Holdings Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Nomura Holdings Inc stock price live, this page displays TYO stock exchange data. View the premarket stock price ahead of the market session. It uses BSE Star MF (with Member code ) as transaction platform. All type of mutual funds are available on Groww. ATTENTION INVESTORS. 1. For Stock. See the latest Nomura Holdings Inc stock price (XTKS), related news, valuation, dividends and more to help you make your investing decisions. Get the latest Nomura Holdings Inc () real-time quote, historical performance, charts, and other financial information to help you make more informed.

Are The Interest Rates Going To Go Down

The average rate on a year fixed-rate mortgage fell seven basis points to % APR, and the average rate on a 5-year adjustable-rate mortgage went down. Those decisions may include raising rates, often in response to rising inflation. And when the Fed raises its target rate, banks typically follow suit and. Mortgage rates dipped this week, with the year fixed rate inching down to percent, according to Bankrate's latest lender survey. Paying Down Your Principal Balance. No payment you make will go toward any of your loan principal until you've paid all your unpaid interest. The US Federal Reserve (Fed) has raised interest rates by another 25 basis points (bps) at the May meeting, bringing the rate to between 5% and %, the. The Consumer Price Index (CPI): Rising CPI usually leads to higher interest rates as lenders seek to maintain profit margins. Gross Domestic Product (GDP). The year fixed-rate mortgage averaged % APR, down 11 basis points from the previous week's average, according to rates provided to NerdWallet by Zillow. The bond market has priced in rising odds of rate cuts in , with the bellwether 5-year — a major driver of fixed mortgage rate pricing — having fallen. The current mortgage interest rates forecast is for rates to embark on a gentle downward trajectory over the remainder of The average rate on a year fixed-rate mortgage fell seven basis points to % APR, and the average rate on a 5-year adjustable-rate mortgage went down. Those decisions may include raising rates, often in response to rising inflation. And when the Fed raises its target rate, banks typically follow suit and. Mortgage rates dipped this week, with the year fixed rate inching down to percent, according to Bankrate's latest lender survey. Paying Down Your Principal Balance. No payment you make will go toward any of your loan principal until you've paid all your unpaid interest. The US Federal Reserve (Fed) has raised interest rates by another 25 basis points (bps) at the May meeting, bringing the rate to between 5% and %, the. The Consumer Price Index (CPI): Rising CPI usually leads to higher interest rates as lenders seek to maintain profit margins. Gross Domestic Product (GDP). The year fixed-rate mortgage averaged % APR, down 11 basis points from the previous week's average, according to rates provided to NerdWallet by Zillow. The bond market has priced in rising odds of rate cuts in , with the bellwether 5-year — a major driver of fixed mortgage rate pricing — having fallen. The current mortgage interest rates forecast is for rates to embark on a gentle downward trajectory over the remainder of

Trevor Tombe outlines the reasons behind recent interest rate hikes and what they could mean to prospective home buyers. At the start of the pandemic the Bank of Canada dropped what would historically be considered a low interest rate of per cent down to just per cent. Analysis by research firm Capital Economics suggests that rates will hit 4% by the end of The future of interest rates depends significantly on how. % – Effective as of: August 29, What is Prime Rate? The Prime Rate is the interest rate that banks use as a basis to set rates for different types. Current mortgage interest rate trends Mortgage rates sit at their lowest level since May The average year fixed rate decreased from % on Aug. The interest rate on a Series I savings bond changes every 6 months, based on inflation. The rate can go up. The rate can go down. For now, that leaves the central bank's benchmark interest rate between % and %, where it has remained since July , and which marks its highest. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. Rising Interest Rates A tight monetary policy refers to central bank policy aimed at cooling down an overheated economy and features higher interest rates and. For now, that leaves the central bank's benchmark interest rate between % and %, where it has remained since July , and which marks its highest. In general, rising interest rates curb inflation while declining interest rates tend to speed inflation. When interest rates decline, consumers spend more as. A return to the historically low home interest rates seen from to is pretty unlikely within the next years, but that doesn't mean we're. We began raising interest rates at the end of to help slow inflation - the rate at which prices are rising. It is working. Inflation has fallen a lot. Increased consumer leverage and rapidly rising interest rates could be the catalyst that pushes the housing market, and possibly the economy, into a slower. Mortgage rates today have downward pressure on them with a likely Fed cut but should hold near current levels. The bond markets have been quiet and no economic. The current Fed interest rate is %% as of 5/1/ See how current Fed rates decisions & Fed rate hikes have impacted US interest rates. Interest rates have held steady in and are unlikely to decline substantially anytime soon, though the Federal Reserve is widely expected to make a cut to. Interest rates are coming down, but perish any hopes of sharp cuts. John 'Time has come' for U.S. Federal Reserve to soon begin reducing interest rates. The current Fed interest rate is %% as of 5/1/ See how current Fed rates decisions & Fed rate hikes have impacted US interest rates.

Should I Get The Car Rental Insurance

This is because the cost of your collision coverage will rise with the value of the vehicle. Choose a car with plenty of safety features. Get a list of safety. The Insurance Institute of America suggests buying "umbrella liability insurance," a low-cost policy added to your auto and homeowners (or renters) insurance. Rental car insurance can help protect you from out-of-pocket expenses in case of an accident, theft, or damage to the rental vehicle, but the daily fee will. Your personal auto insurance policy's third-party liability coverage extends to rental cars, protecting against damage to other people and property due to a. But you might not necessarily have to buy rental car insurance for that purpose. Most of the credit card companies and personal liability and personal car. Personal Auto Insurance Coverage. The coverage that you have for your own car generally applies to rental cars, as long as you aren't using the car for business. In most instances, rental car insurance overlaps with your personal auto insurance policy and you won't need to pay for duplicate coverage. Your personal car insurance might cover rental cars. Remember that it may only be for personal use, not for business purposes. You may need to purchase separate. Personal Auto Insurance Coverage. The coverage that you have for your own car generally applies to rental cars, as long as you aren't using the car for business. This is because the cost of your collision coverage will rise with the value of the vehicle. Choose a car with plenty of safety features. Get a list of safety. The Insurance Institute of America suggests buying "umbrella liability insurance," a low-cost policy added to your auto and homeowners (or renters) insurance. Rental car insurance can help protect you from out-of-pocket expenses in case of an accident, theft, or damage to the rental vehicle, but the daily fee will. Your personal auto insurance policy's third-party liability coverage extends to rental cars, protecting against damage to other people and property due to a. But you might not necessarily have to buy rental car insurance for that purpose. Most of the credit card companies and personal liability and personal car. Personal Auto Insurance Coverage. The coverage that you have for your own car generally applies to rental cars, as long as you aren't using the car for business. In most instances, rental car insurance overlaps with your personal auto insurance policy and you won't need to pay for duplicate coverage. Your personal car insurance might cover rental cars. Remember that it may only be for personal use, not for business purposes. You may need to purchase separate. Personal Auto Insurance Coverage. The coverage that you have for your own car generally applies to rental cars, as long as you aren't using the car for business.

The best rental car insurance is your personal car insurance policy. If you already have car insurance for your personal vehicle, you should be covered up to. Buying supplemental insurance from the rental company— can add approximately $15 to $30 per day to the cost of the rental. However, if you already have an. If you have only basic liability coverage, you may want to consider purchasing supplemental liability insurance from the rental company to help cover the costs. Conversely you could end up paying for extra coverage that you don't need. All major rental car companies will display their terms and conditions on their. Remember, rental car insurance is not required by law and may already be covered by your personal car insurance. You do, however, need some sort of liability. Yes, it's highly recommended to have insurance for a rental car. Having the right coverage in place may prevent you from paying out of pocket to cover the cost. Your personal automobile insurance policy may provide coverage for your liability while operating a rental vehicle. The purchase of automobile rental liability. Although the physical damage coverage you can buy from rental car companies covers loss-of-use penalties, we advise most drivers decline it. To us, paying an. Ultimately, you want to have affordable car insurance when you rent a car while getting all the protection you need. Avoid car rental insurance costs by doing. DW is not insurance. The purchase of DW is optional and not required to rent a car. The protection provided by DW may duplicate the renter's existing coverage. However, there's one type of insurance you should get: a collision damage waiver, which covers costs associated with rental car damage or theft. It's smart to. Your auto policy should be sufficient as long as you have confirmed the coverage carries over while renting. Be certain to do a full walk. If your car was damaged due to another driver's negligence, the other driver's insurance company should pay your rental car costs for a reasonable length of. You will need to meet minimum standards for liability, and you can rest assured that the rental insurance will cover you in the event of an accident. You can. Only Buy Optional Coverage Products You Need The cost of optional coverage products sold by car rental companies can significantly increase the cost of a car. Does car insurance cover rental cars? If you drive an insured car at home, you may not have to buy car rental insurance. “In most cases, whatever auto. The best rental car insurance is your personal car insurance policy. If you already have car insurance for your personal vehicle, you should be covered up to. This could include reimbursing you for your car insurance deductible if you make a claim or paying for the entire cash value of the vehicle if it is totaled. 7 things to know about rental car coverage · 1. It's optional. · 2. There is a limit. · 3. Your vehicle must be in the shop due to a covered loss. · 4. You can use. Although your existing car insurance may cover your rental car, every policy is different. It's best to call and find out all the details of your coverage.

How Can I Raise My Credit

The way to get a better credit score is to 1) consistently not have a ton of debt, 2) pay down the debt you have at regular and consistent intervals, and 3). Opening more credit accounts is a great way to improve your credit score over a couple of months because it doesn't require a large chunk of money upfront. How to Improve Your Credit Score Fast · 1. Review Your Credit Reports · 2. Get a Handle on Bill Payments · 3. Aim for 30% Credit Utilization or Less · 4. Limit. How To Increase Your Credit Score · 1. Read Your Credit Report · 2. Pay Your Bills on Time · 3. Set Up Payment Plans With Creditors · 4. Limit Applying for New. Request a Higher Credit Limit Online. Log in to your credit card company's website, pull up your account's main menu and look for the option to ask for a higher. Here are four such options designed for consumers without credit—or those with a low credit score—which can help boost your credit rating at no cost to you. Following a budget, keeping an emergency savings, and avoiding taking on too much debt in the first place can make it easier to care for your credit. Trying to raise your credit score? · Keep track of your progress. · Always pay bills on time. · Keep credit balances low. · Pay your credit cards more than once a. 6 easy tips to help raise your credit score · 1. Make your payments on time · 2. Set up autopay or calendar reminders · 3. Don't open too many accounts at once. The way to get a better credit score is to 1) consistently not have a ton of debt, 2) pay down the debt you have at regular and consistent intervals, and 3). Opening more credit accounts is a great way to improve your credit score over a couple of months because it doesn't require a large chunk of money upfront. How to Improve Your Credit Score Fast · 1. Review Your Credit Reports · 2. Get a Handle on Bill Payments · 3. Aim for 30% Credit Utilization or Less · 4. Limit. How To Increase Your Credit Score · 1. Read Your Credit Report · 2. Pay Your Bills on Time · 3. Set Up Payment Plans With Creditors · 4. Limit Applying for New. Request a Higher Credit Limit Online. Log in to your credit card company's website, pull up your account's main menu and look for the option to ask for a higher. Here are four such options designed for consumers without credit—or those with a low credit score—which can help boost your credit rating at no cost to you. Following a budget, keeping an emergency savings, and avoiding taking on too much debt in the first place can make it easier to care for your credit. Trying to raise your credit score? · Keep track of your progress. · Always pay bills on time. · Keep credit balances low. · Pay your credit cards more than once a. 6 easy tips to help raise your credit score · 1. Make your payments on time · 2. Set up autopay or calendar reminders · 3. Don't open too many accounts at once.

Can You Raise Your Credit Score By Points in 30 Days? · Lower your credit utilization rate · Ask for late payment forgiveness · Dispute inaccurate. The best practice is to pay your credit card bills in full every month. If you can't, pay as much as possible. Try to keep your credit utilization rate below. Focusing on good financial practices like paying off your credit card balances in full each month will go a long way towards increasing your credit score. Certainly! Here are 20 important ways to boost your credit score: · 1. Pay bills on time · 2. Keep credit card balances low · 3. Use credit. What actions you can take to boost your credit scores? · Pay your bills more frequently. · Pay down your debt but keep old credit accounts open. · Request an. 3. Ask for a credit limit raise Another trick that can help lower your utilization: Ask your card issuer to increase your limit. Issuers are generally willing. Nothing will raise your credit score faster or more effectively than paying bills on time and using your credit cards judiciously. 1. Review credit regularly. First things first, you'll likely want to monitor your credit regularly. That way, you can have an idea of where your credit stands. You can raise your score over time by demonstrating that you consistently manage your credit responsibly. Here are 10 things you can do to improve your credit. You can follow these simple steps to help improve it. Rule 1: Make. Every. Payment. Late payments can stay on your record for up to 7 years. The way to get a better credit score is to 1) consistently not have a ton of debt, 2) pay down the debt you have at regular and consistent intervals, and 3). Reduce the amount of debt you owe · Keep balances low on credit cards and other revolving credit · Pay off debt rather than moving it around · Don't close. My vantage is , Fico I would like to get in the quickest way possible but would also like to do it in a smart way. Here are 10 ways to increase your credit score by points - most often this can be done within 45 days. Below, Select details how you can quickly raise your credit limit — and potentially your credit score — by simply updating your income information with your. Learn the basics of how to build credit, how to use credit cards and practice positive credit behavior. If your creditworthiness has taken a ding, these fixes should spruce it up · 1. Check your credit report at least once a year · 2. Set up automatic bill payment. 1. Pay your bills when they're due. Paying your bills on time is one of the biggest contributors to your overall credit score. A sure-fire way of paying bills on time is by setting recurring payments on "auto pay" in your online banking account. This article gives an overview of how to improve your credit score fast and reliably, including the 4 biggest-impact tips you can implement this week.

Asset Based Mortgage Refinance

Asset-based lending is the business of loaning money with an agreement that is secured by collateral that can be seized if the loan is unpaid. Real estate asset-based lending is based almost exclusively on real estate assets used as collateral for financing. After receiving all of the financial. Let your assets do the talking with an asset-based home loan. · Financing available for owner-occupied, non-owner occupied second homes, units, and PUDs. Asset Refinance is a secured loan, repaid using Fixed Monthly Repayments over an agreed period, or term, that can extend as far as 5 years. An asset depletion mortgage, also referred to as an asset-based mortgage, allows borrowers to qualify for a mortgage based on their liquid assets rather than. Compared to unsecured loans, asset-based loans have much lower rates. In general, asset-based loan rates range from % to 15%. The financing can be. Mortgage qualify using assets ONLY · Asset Based Mortgages are for people who don't need financing but prefer a mortgage. Eligible Assets: Checking, Savings. Non-QM (non-qualified mortgage) asset utilization mortgage loan programs are designed for borrowers who have significant assets but may not have a high. With ABL, a lender will instead focus primarily on the value of your business's assets, which are used as collateral to secure a loan. First on the list is. Asset-based lending is the business of loaning money with an agreement that is secured by collateral that can be seized if the loan is unpaid. Real estate asset-based lending is based almost exclusively on real estate assets used as collateral for financing. After receiving all of the financial. Let your assets do the talking with an asset-based home loan. · Financing available for owner-occupied, non-owner occupied second homes, units, and PUDs. Asset Refinance is a secured loan, repaid using Fixed Monthly Repayments over an agreed period, or term, that can extend as far as 5 years. An asset depletion mortgage, also referred to as an asset-based mortgage, allows borrowers to qualify for a mortgage based on their liquid assets rather than. Compared to unsecured loans, asset-based loans have much lower rates. In general, asset-based loan rates range from % to 15%. The financing can be. Mortgage qualify using assets ONLY · Asset Based Mortgages are for people who don't need financing but prefer a mortgage. Eligible Assets: Checking, Savings. Non-QM (non-qualified mortgage) asset utilization mortgage loan programs are designed for borrowers who have significant assets but may not have a high. With ABL, a lender will instead focus primarily on the value of your business's assets, which are used as collateral to secure a loan. First on the list is.

Expect asset-based lending rates to be in the range of % interest depending on the loan to value ratio, lender, property type and location, strength of the. Also known as securities-backed mortgages, asset-based mortgages are secured against liquid assets instead of the properties being financed. This type of high-. Also known as asset-based lending or asset depletion loans, these non-QM mortgages assess a borrower's total assets rather than income. This empowers. Asset-based financing is also beneficial for property buyers. Unlike a reverse mortgage, you can apply for an asset-based loan for a second property that's not. We also offer asset-based refinance loans in which no cash is taken out. To qualify, the mortgage must have a maximum loan-to-value ratio of 80%, which. Asset Based Lending is a trusted hard money lender for real estate investors & small business owners. See how you can get direct private loans near you. Your assets are collateral for paying back the loan instead of your income. This type of asset-based lending uses different forms of assets, including money. How Does an Asset Depletion Loan Work? Asset depletion mortgage loans are a type of loan that allows homeowners to use the value of their assets instead of. Use asset-based lending solutions for: · Working capital · Merger and acquisition financing · Recapitalization · Refinancing/restructuring existing debt · Leveraged. Asset Depletion Loans – Asset Based Mortgage Programs What is an Asset Depletion Loan? An asset Depletion Loan otherwise known as an Asset Based Loan allows. Asset-based lending is the business of loaning money with an agreement that is secured by collateral that can be seized if the loan is unpaid. Asset backed loans save you from having to liquidate the asset and take tax hits. So depending on how low your cost basis is your tax on the. One way to secure an Asset Based Mortgage, will be to work with a Private Bank. There is a big cost though. Asset-based Lending Put your business assets to work for you. Loans are secured by assets such as accounts receivable, inventory, machinery, equipment and. The easiest way to accomplish this with a conventional loan is with a trust account and verified disbursements. Asset refinancing is essentially allowing lenders to look at the equity (share) you currently have in an asset and based on that evaluation you will receive a. Asset-based loans can be used on various commercial real estate properties, such as offices, self-storage, and light industrial. Compared to cash flow lending. Asset Depletion loans are also known as “asset based mortgages”. Some people even refer to them as “no income, high asset loans”. Asset-based structures provide a revolving line of credit using eligible accounts receivable and inventory from your business. You could also opt for a term. Asset Qualifier loans are also known as “asset based mortgages”. Some people even refer to them as “no income, high asset loans”.

Refinance Mortgage Pa

Discover mortgage refinance rates at Citizens to access cash, reduce payments, or pay for home improvements. Today's mortgage refinance rates await you. Home buyers in Pennsylvania will find a lot of variation throughout the state in terms of price, real estate taxation, and affordability based on local incomes. The rule of thumb has been that refinancing is a good idea if you can reduce your interest rate by at least 2%. However, many lenders say 1% savings is enough. Pennsylvania refinance companies can help if you are looking for options to help pay off an existing mortgage. One of the reasons that you might want to. The average mortgage rate in Pennsylvania is currently % for a year fixed loan term and % for a year fixed loan term. If you're ready to explore the potential benefits of refinancing your mortgage in Pennsylvania (PA) or Florida (FL), don't hesitate to reach out to us. Apply. PHFA offers the following Refinance loan programs for existing homeowners. What you choose will depend on your individual situation. Clearview Federal Credit Union offers valuable banking solutions including checking accounts, savings accounts, auto loans, mortgages, personal loans, home. Compare today's Pennsylvania mortgage rates. Get free, customized quotes from lenders in your area to find the lowest rates. Discover mortgage refinance rates at Citizens to access cash, reduce payments, or pay for home improvements. Today's mortgage refinance rates await you. Home buyers in Pennsylvania will find a lot of variation throughout the state in terms of price, real estate taxation, and affordability based on local incomes. The rule of thumb has been that refinancing is a good idea if you can reduce your interest rate by at least 2%. However, many lenders say 1% savings is enough. Pennsylvania refinance companies can help if you are looking for options to help pay off an existing mortgage. One of the reasons that you might want to. The average mortgage rate in Pennsylvania is currently % for a year fixed loan term and % for a year fixed loan term. If you're ready to explore the potential benefits of refinancing your mortgage in Pennsylvania (PA) or Florida (FL), don't hesitate to reach out to us. Apply. PHFA offers the following Refinance loan programs for existing homeowners. What you choose will depend on your individual situation. Clearview Federal Credit Union offers valuable banking solutions including checking accounts, savings accounts, auto loans, mortgages, personal loans, home. Compare today's Pennsylvania mortgage rates. Get free, customized quotes from lenders in your area to find the lowest rates.

This Pennsylvania refinance calculator was designed for mortgage loan officers & homeowners. Simply enter the mortgage payoff(s) & any other monthly debt. Initial rates displayed are based on a $, loan for a purchase or refinance transaction of an owner occupied, single-family residence with % LTV and. PHFA offers homeownership professionals / lenders the following refinance loan programs for existing homeowners. HFA Program Information. What is a mortgage refinance? Refinancing your mortgage means replacing an existing home loan with a new one. You usually follow the same steps you did to apply. Explore options to refinance your home in PA & MD with local lenders Orrstown Bank. Contact a loan officer today & receive same-day pre-qualification! What Refinancing Means · Pennsylvania Refinancing Experts Show Home Owners Ways to Save Big · You aren't stuck with those High Interest Rates · Change the Length. Compare loan terms to find the one that's right for you or see rates for a variety of refinancing options. See refinance rates. Refinancing your mortgage could serve any of the four purposes: Lowering your interest rate; Changing your loan type; Altering your loan repayment term; Cashing. Today, the mortgage rate for a year fixed loan in Pennsylvania is about %. For the most part, mortgage rates will be similar for everyone right now, no. Refinancing with a 1st lien home equity loan offers significant cost savings in the form of much lower fees and closing costs. Find current mortgage refinance rates in and when to refinance. Learn how to refinance your house and find the answers to more questions here. RBC Royal Bank's easy-to-use mortgage calculators and tools can help you estimate your payments and how much you can afford. When you refinance your mortgage, you replace your existing home loan with a new one. The process of applying for a home loan refinance is similar to what you. Today's mortgage rates in Philadelphia, PA are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). Today's Fixed Rate%% APR Fixed Mortgage · Choose loan type · Mortgage Rate Trends · Compare Mortgage Refinance Offers · Lower Your Interest Rate · Shorten. Normally PMI is required if you have less than 20% equity in your home, however for the refinance of loan guaranteed by Freddie Mac or Fannie Mae you may not be. The current average year fixed mortgage rate in Pennsylvania remained stable at %. Pennsylvania mortgage rates today are 2 basis points higher than the. Looking for a home loan? Tompkins Community Bank in PA and NY can help you find the right mortgage or refinance loan today. View our low refinancing rates. Current Mortgage and Refinance Rates in Pennsylvania ; 30 Year Fixed Conv, %, % ; 15 Year Fixed Conv, %, % ; 30 Year Fixed FHA, %, %. When you refinance, you are paying off your lender for the existing loan. At the same time, you are qualifying for a new loan to replace it, whether or not you.

Current Capital One Promotions

Open a new Checking account. Use promo code REWARD at account opening. Set up and receive 2 qualifying direct deposits of $ or more within 75 days of. Capital One Quicksilver Cash Rewards Credit Card(Rates and fees): 0% intro APR for 15 months on purchases and balance transfers, then % - % (variable). Capital One Venture X Credit Card: 75, Bonus Miles — $ Value · Capital One SavorOne Rewards Credit Card: $ Bonus · Capital One Quicksilver Credit Card. See what employees say it's like to work at Capital One Promotions. Salaries, reviews, and more - all posted by employees working at Capital One Promotions. High-Interest Savings Accounts from Discover Bank, Member FDIC offer high Capital One. Performance Savings. Remove Bank. Marcus. Online Savings. Capital One may occasionally offer discount codes, but currently, there are none available. However, customers can still save money by taking advantage of. Capital one has a bonus offer for starting a Performance Savings account @ % interest, that pays a $1, bonus after transferring K. Capital One's Checking account features no monthly fees, including overdraft fees, and no minimum balance or deposit requirements. Banking Reimagined® at Capital One. No fees with our consumer checking accounts or at our + fee-free ATMs. Open a bank account in about 5 minutes. Open a new Checking account. Use promo code REWARD at account opening. Set up and receive 2 qualifying direct deposits of $ or more within 75 days of. Capital One Quicksilver Cash Rewards Credit Card(Rates and fees): 0% intro APR for 15 months on purchases and balance transfers, then % - % (variable). Capital One Venture X Credit Card: 75, Bonus Miles — $ Value · Capital One SavorOne Rewards Credit Card: $ Bonus · Capital One Quicksilver Credit Card. See what employees say it's like to work at Capital One Promotions. Salaries, reviews, and more - all posted by employees working at Capital One Promotions. High-Interest Savings Accounts from Discover Bank, Member FDIC offer high Capital One. Performance Savings. Remove Bank. Marcus. Online Savings. Capital One may occasionally offer discount codes, but currently, there are none available. However, customers can still save money by taking advantage of. Capital one has a bonus offer for starting a Performance Savings account @ % interest, that pays a $1, bonus after transferring K. Capital One's Checking account features no monthly fees, including overdraft fees, and no minimum balance or deposit requirements. Banking Reimagined® at Capital One. No fees with our consumer checking accounts or at our + fee-free ATMs. Open a bank account in about 5 minutes.

Enjoy unlimited access to Capital One Lounge locations with Venture X. Plus, earn 75k bonus miles when you spend $4, on purchases in the first 3 months from. Capital One may occasionally offer discount codes, but currently, there are none available. However, customers can still save money by taking advantage of. Grow your money with a 6-month guaranteed rate of up to % APY when you open a business savings account with Capital One. When you partner with us, you get. Capital One CD rates are % to % APY. Capital One CD rates are more competitive than the average CD rate, regardless of which term you want. That. Personal Savings Account - $1, Bonus. Open a new Performance Savings account. Use promo code BONUS at account opening. Deposit at least $, of. Capital One rewards cardholders can redeem their rewards for MLB tickets Visit Capital One Entertainment to view current offerings and to learn more. Once installed on your desktop browser, Capital One Shopping helps you save money in three ways: searching for coupons and promo codes, comparing prices at. Earn 75, bonus miles with your Capital One Venture Card once you spend $4, on purchases in your first 3 months from account opening View important. Earn a one-time $ cash bonus after you spend $ on purchases within 3 months from account opening · Earn unlimited % cash back on every purchase, every. I currently have mine with Bank of America, and then a high yield savings with capital one. Thanks! Archived post. New comments cannot be. SavorOne Rewards · Earn a one-time $ cash bonus once you spend $ on purchases within 3 months from account opening · Earn 20, bonus miles once you spend. cash back on every purchase, every day, and rewards don't expire for the life of the account. Earn $ as a one-time cash bonus once you spend $ within 3. Start earning rewards on every purchase. Choose from our suite of cards designed with business in mind. Meet with a banking associate at a Capital One. Eligibility: Capital One Incentive Offer (the "Offer") is open to individuals who are legal residents of the 50 United States and D.C., Puerto Rico & U.S. Update 9/5/ For a limited time, Capital One is currently offering a $ checking bonus after meeting the simple requirements! Table of Contents. Toggle. Current APY, %. Our top contenders, My Banking Direct. Current APY, %. Capital One. Current APY, %. Our top contenders, BrioDirect. Current APY, Current Capital One Coupon Codes & Deals ; FREE APP, Free Capital One App, 11/15/ ; $ & UP, New Cars as Low as $ ; $ & UP, Used Cars from $ Earn up to a $ bonus when you open a new, eligible US Bank business checking account online with promo code Q3AFL24 and complete qualifying activities. Eligibility: Capital One Incentive Offer (the "Offer") is open to individuals who are legal residents of the 50 United States and D.C., Puerto Rico & U.S.

Getting Loan For Home Improvement

A home renovation loan allows you to roll the costs of repairs or upgrades into refinancing your current mortgage, or into the mortgage for the home you buy. A loan for home improvements can unlock potential in your property and provide the funding for desired upgrades. Our online process makes it easy to apply for a home renovation loan. Fix a leaky roof, remodel your kitchen, or update your backyard—we're here to help. The USDA also has a program designed to help borrowers pay for remodeling a home. Since USDA loans are intended for people who otherwise wouldn't get a mortgage. You do have options when it comes to financing, though, including home equity, refinancing, an FHA home improvement loan, a credit card, or a personal loan. Unsecured loans require a construction bid or documentation of materials to be purchased but do not add a lien to your property. An unsecured loan is great for. Fixer-upper loans — also known as renovation loans — are mortgages that typically offer you enough money to buy a new home and pay for repairs at the same time. Cover the cost of your home improvement project, big or small. · Home equity line of credit (HELOC) · Home equity loan · Cash-out refinance · Home improvement. As for options, HELOC, home equity loan or cash out refi. Yes rates are higher right now than they have been for a while, there's nothing you. A home renovation loan allows you to roll the costs of repairs or upgrades into refinancing your current mortgage, or into the mortgage for the home you buy. A loan for home improvements can unlock potential in your property and provide the funding for desired upgrades. Our online process makes it easy to apply for a home renovation loan. Fix a leaky roof, remodel your kitchen, or update your backyard—we're here to help. The USDA also has a program designed to help borrowers pay for remodeling a home. Since USDA loans are intended for people who otherwise wouldn't get a mortgage. You do have options when it comes to financing, though, including home equity, refinancing, an FHA home improvement loan, a credit card, or a personal loan. Unsecured loans require a construction bid or documentation of materials to be purchased but do not add a lien to your property. An unsecured loan is great for. Fixer-upper loans — also known as renovation loans — are mortgages that typically offer you enough money to buy a new home and pay for repairs at the same time. Cover the cost of your home improvement project, big or small. · Home equity line of credit (HELOC) · Home equity loan · Cash-out refinance · Home improvement. As for options, HELOC, home equity loan or cash out refi. Yes rates are higher right now than they have been for a while, there's nothing you.

Home equity loans—sometimes called home improvement loans—allow you to borrow against the equity in your home. Navy Federal offers 2 types: Fixed-Rate Home. When people talk about home improvement loans, also referred to as home repair or renovation loans, they can be talking about personal loans. This type of loan. How to Get a Home Improvement Loan · Consider your eligibility. Generally, you'll need at least a FICO credit score to be approved for a home improvement. This loan features: Borrow up to $25k. Repayment terms up to seven years. Your home's equity is untouched. How to finance home renovations · Must use an approved lender · Must pay insurance premium of 1% per $ of loan amount annually · Repair types may be limited by. Home improvement loans help you fund your home renovation projects. They're structured like traditional loans, so they don't require equity in your home. A home improvement loan is a way to finance home renovations. You typically get a home improvement loan by borrowing against the value of your home's equity. Whether you need to make necessary repairs or simply want to update your home, a Fix Up loan may be able to finance most home improvement projects for eligible. Qualifying homebuyers and homeowners can make renovations and additions to their home with one simple loan that covers both the mortgage and the renovation. Home Renovation Loans · Purchase a fixer-upper or refinance for renovation with a mortgage from WesBanco. · Get Started Today! · Find a Location Near You! · Get in. Use a Rocket Loans home improvement loan for quick funding from $ - $ for your next project, no collateral needed. Apply today to see your rate. A home improvement loan is like a personal loan in that it is an unsecured (no collateral) loan that can be used for home renovations, repairs, and/or home. 3 quick steps to get your Home Improvement Loan · 1. Check your rate. Securely share your basic financial information to see what interest rate you may qualify. You can save thousands in interest by using a Home Equity Loan or HELOC to fund your renovations, versus using an unsecured loan or line of credit. Discover home improvement loan options to upgrade your home. Get expert advice and tips to secure the best type of loan for your needs. Image. Before & After: a. Our home improvement loan is an unsecured loan—meaning your home equity, or anything else, is not on the line. Absolutely No Fees required. Surprises are almost. More Lending Options · Personal Loan · Home Equity Line of Credit (HELOC) · Home Equity Loan. Home renovation loans can either be an important tool for leveraging value-adding projects or provide you the means of getting emergency repairs taken care of. Home equity loans—sometimes called home improvement loans—allow you to borrow against the equity in your home. Navy Federal offers 2 types: Fixed-Rate Home. Find the perfect home improvement loan: · Get the cash you need by refinancing your existing mortgage · Tap into your home's equity with a Home Equity Loan or.