happygamestation.ru

Community

Stock Market Today Usa

View the MarketWatch summary of the U.S., Europe and Asia stock markets, currencies, cryptocurrencies, rates and futures. Stocks News · Wall Street indexes close up; data keeps smaller Fed rate cut in view · Morning Bid: Weekly rebound in reach, China data deluge looms · US judge. Up to date market data and stock market news is available online. View US market headlines and market charts. Get the latest economy news, markets in our. Stock Spotlight ; Most Actives · NVIDIA CORP. $ ; Top Gainers · ORACLE CORP. $ ; Top Losers · HUMANA INC. $ US stocks that increased the most in price ; GV · D · +%, USD, M · ; OBLG · D · +%, USD, M · Stock market quotes, news, charts, financials, technical analysis and stocks, indexes, commodities, forex trading strategies. U.S. STOCKS ; Nasdaq Composite, , ; S&P , , ; DJ Total Stock Market, , ; Russell , , Total Stock Market · Total Stock Market. , , , , , , , , , , Barron's · Barron's. Today's market ; NYSE COMPOSITE (DJ), 18,, (%) ; NYSE U.S. INDEX, 16,, (%) ; DOW JONES INDUSTRIAL AVERAGE, 40, View the MarketWatch summary of the U.S., Europe and Asia stock markets, currencies, cryptocurrencies, rates and futures. Stocks News · Wall Street indexes close up; data keeps smaller Fed rate cut in view · Morning Bid: Weekly rebound in reach, China data deluge looms · US judge. Up to date market data and stock market news is available online. View US market headlines and market charts. Get the latest economy news, markets in our. Stock Spotlight ; Most Actives · NVIDIA CORP. $ ; Top Gainers · ORACLE CORP. $ ; Top Losers · HUMANA INC. $ US stocks that increased the most in price ; GV · D · +%, USD, M · ; OBLG · D · +%, USD, M · Stock market quotes, news, charts, financials, technical analysis and stocks, indexes, commodities, forex trading strategies. U.S. STOCKS ; Nasdaq Composite, , ; S&P , , ; DJ Total Stock Market, , ; Russell , , Total Stock Market · Total Stock Market. , , , , , , , , , , Barron's · Barron's. Today's market ; NYSE COMPOSITE (DJ), 18,, (%) ; NYSE U.S. INDEX, 16,, (%) ; DOW JONES INDUSTRIAL AVERAGE, 40,

Stocks ; CDE Coeur Mining, Inc. + (+%). + ; MPW Medical Properties Trust, Inc. + (+%). + ; SIG Signet Jewelers Limited. All NYSE markets observe U.S. holidays as listed below for , , and * Each market will close early at p.m. ( p.m. for eligible options). Updated world stock indexes. Get an overview of major world indexes, current values and stock market data US Edition. Subscribe. Markets. Stocks. Before. Capture U.S. stock market exposure with ease utilizing SPX suite of options Odd Lots. Notional Value Summary; Volume Summary. Today; 5 Day Avg; MTD. Dow Jones Futures 41, (%) · Nasdaq 17, (%) · S&P 5, (%). Audio Close Schwab Market Update · The SPX gained 42 points (%) to 5,; the Dow Jones Industrial Average® ($DJI) rose points (%) to 41,;. Stock market today: S&P hits 4-day winning streak as stocks rise after Stock quotes by happygamestation.ru · Contact Us · Masthead · Your Privacy Choices. The Dow Jones U.S. Total Stock Market Index, a member of the Dow Jones Total Stock Market Indices family, is designed to measure all U.S. equity issues with. Audio Close Schwab Market Update · The SPX gained 42 points (%) to 5,; the Dow Jones Industrial Average® ($DJI) rose points (%) to 41,;. CNBC is the world leader in business news and real-time financial market coverage. Find fast, actionable information. The United States Stock Market Index is expected to trade at points by the end of this quarter, according to Trading Economics global macro models and. Get the latest stock market news, stock information & quotes, data analysis reports, as well as a general overview of the market landscape from Nasdaq. Yahoo Finance. 10 hours ago. Stock market today: S&P , Nasdaq jump for 4th straight day as tech leads stocks higher ; CNBC. 4 hours ago. Boeing workers. Find the latest stock market trends and activity today. Compare key indexes, including Nasdaq Composite, Nasdaq, Dow Jones Industrial & more. Check out the best stock market forecasts and trading ideas: USA. Live stock quotes, latest news, earnings calendar, and much more. A stock market site by Business Insider with real-time data, custom charts and breaking news. Get the latest on stocks, commodities, currencies, funds. Stock market quotes, news, charts, financials, technical analysis and stocks, indexes, commodities, forex trading strategies. Find the latest stock market trends and activity today. Compare key indexes U.S. Pre Market - Market Opens in 6M 5S. Market Activity. Find a Symbol. The regular schedule for the New York Stock Exchange and Nasdaq is Monday through Friday from am to 4 pm Eastern time with weekends off.

Cash Margin Account

A margin account allows you to borrow cash from Firstrade to purchase securities. The loan in the margin trading account is collateralized by the securities. Your broker also cannot lend out the securities you hold in a cash account without your permission. In a margin account, your broker may lend your shares to. A margin account allows you to borrow money from a brokerage firm to buy securities. This is also the only type of account in which investors can engage in. Customer Margin Balance Reporting and Margin Statistics · the total of all debit balances in securities margin accounts · all free credit balances in all cash. The main difference between margin and cash accounts is: cash accounts must have cash available on or before settlement date for purchasing securities, whereas. In contrast to cash accounts, margin accounts offer the ability to leverage your assets and increase your buying power. This financial maneuvering offers. A margin account is a standard brokerage account in which an investor is allowed to use the current cash or securities in their account as collateral for a loan. Interest rates are paid on the cash portion of Investment and Registered accounts. Both cash and securities can be held in the same account. Investment accounts. For example, if you had $5, cash in a margin-approved brokerage account, you could buy up to $10, worth of marginable stock: You would use your cash. A margin account allows you to borrow cash from Firstrade to purchase securities. The loan in the margin trading account is collateralized by the securities. Your broker also cannot lend out the securities you hold in a cash account without your permission. In a margin account, your broker may lend your shares to. A margin account allows you to borrow money from a brokerage firm to buy securities. This is also the only type of account in which investors can engage in. Customer Margin Balance Reporting and Margin Statistics · the total of all debit balances in securities margin accounts · all free credit balances in all cash. The main difference between margin and cash accounts is: cash accounts must have cash available on or before settlement date for purchasing securities, whereas. In contrast to cash accounts, margin accounts offer the ability to leverage your assets and increase your buying power. This financial maneuvering offers. A margin account is a standard brokerage account in which an investor is allowed to use the current cash or securities in their account as collateral for a loan. Interest rates are paid on the cash portion of Investment and Registered accounts. Both cash and securities can be held in the same account. Investment accounts. For example, if you had $5, cash in a margin-approved brokerage account, you could buy up to $10, worth of marginable stock: You would use your cash.

Cash accounts require investors to pay % for each security transaction and prohibit strategies that involve unlimited loss potential like short-selling. No Settlement Period. With margin accounts proceeds are immediately available to use when you close a position, this no settlement period benefit is required. Instructions · Cash accounts can upgrade to a Margin account. · To upgrade to a Portfolio Margin account, you must be approved to trade options and your account. It is a non-margin account, meaning that it does not allow for margin trading. A cash trading account may also be referred to as a cash account or a cash-only. Cash and margin accounts offer traders & investors different levels of access to strategies, leverage within the account, and more. trading on margin? When you place trades in a cash account, you can only buy and sell securities with cash. You can't borrow against your securities to make. A “margin account” is a type of brokerage account in which the broker-dealer lends the investor cash, using the account as collateral, to purchase securities. Yes, an investor can withdraw cash from a margin account but it can come with limitations. This may be limited to the cash value of the account, which is often. Investors use margin accounts to increase their purchasing power by buying more securities than they would've bought using their cash deposits. Generally, a. A cash account only contains an investor's funds, while a margin account offers investors additional purchasing power by giving them the ability to borrow money. When opening a brokerage account, investors have two main options: a cash account or a margin account. The difference between them is how and when you pay for. Cash & Borrowing Margin — How much money do you have available to withdraw that includes cash along with the loan value of the securities held in your margin. A margin account allows clients to borrow money from their broker to buy securities, using those securities as collateral for the loan. Tiger Trade is a mobile trading app offering real time data, low commission fees and a free demo account. Download now to start investing in ETFs. You can use margin to finance securities purchases or to borrow against securities already held in your account. You must deposit at least $2, in cash or. There is no account minimum to open or maintain a cash account at tastytrade, nor are there any account maintenance or inactivity fees. Cash accounts only allow. This guide will help you to know the advantages and risks between margin and cash accounts. And even more, it will help you to decide which one fits your needs. tastytrade offers margin and cash accounts, including individual and joint accounts, individual retirement accounts (IRAs), as well as entity and trust accounts. To begin borrowing at Schwab, your account must contain at least $2, in cash or marginable securities. View more important information about margin loan. Unlike a margin account, a cash account cannot borrow money from MEXEM to purchase happygamestation.ru can upgrade from a cash to margin account as described in: How do.

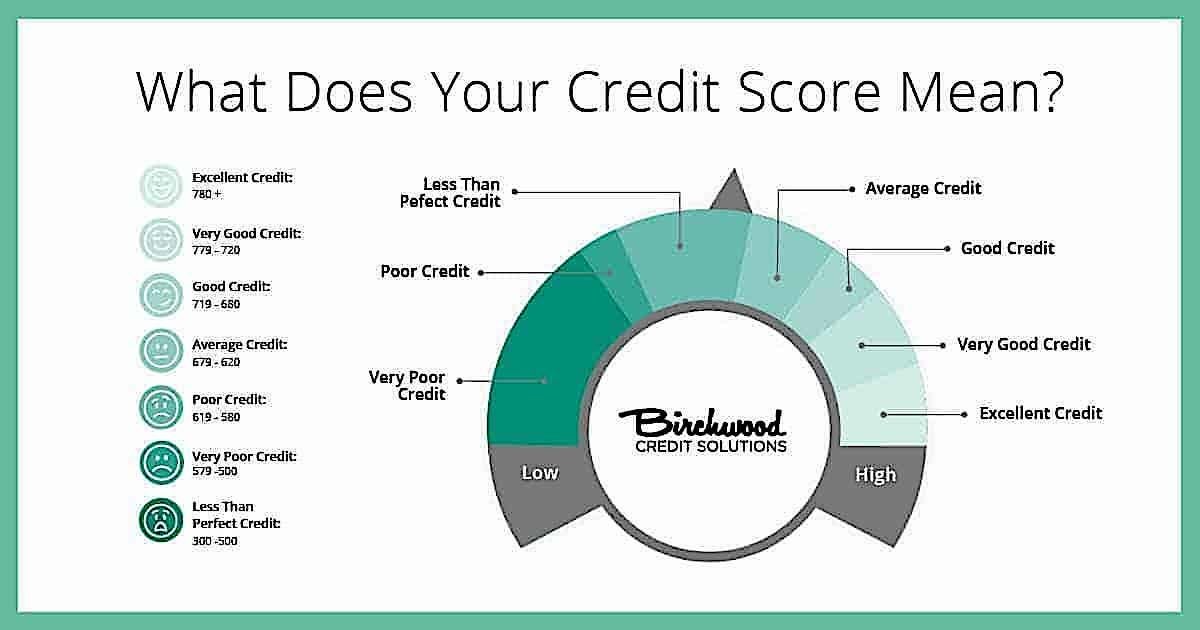

How Good Is A 620 Credit Score

A credit score is considered a “fair” score. That means it's higher than a “poor” score yet lower than a “good” one. Credit Score Below · Sub-Prime Borrowers Can SAVE UP TO $ · Sub-Prime Borrowers Can SAVE UP TO $ · Sub-Prime Borrowers Can SAVE UP TO $ A credit score of is a “bad” credit score, unfortunately. It is 80 points away from being a “good” credit score, which many people use as a benchmark. Having a credit score places you below the national average and into the “fair credit” category. Subprime is the categorization lenders use to designate the. While different lenders have their own standards for rating credit scores, scores above the high s (on a scale of to ) are generally considered. In conclusion, while a credit score may present certain challenges in the mortgage market, it is by no means a barrier to homeownership. FHA loans offer a. A score is a 'fair' credit score and is considered subprime, which means your credit or loan application may have undesirable conditions that can. No,A good credit score ranges from If you have a score of and above, banks and other NBFC's consider you to be credit healthy. But. Majority of lenders feel credit score of is high risk to issue credit cards and sanction any loans. You may get secured credit card (will be. A credit score is considered a “fair” score. That means it's higher than a “poor” score yet lower than a “good” one. Credit Score Below · Sub-Prime Borrowers Can SAVE UP TO $ · Sub-Prime Borrowers Can SAVE UP TO $ · Sub-Prime Borrowers Can SAVE UP TO $ A credit score of is a “bad” credit score, unfortunately. It is 80 points away from being a “good” credit score, which many people use as a benchmark. Having a credit score places you below the national average and into the “fair credit” category. Subprime is the categorization lenders use to designate the. While different lenders have their own standards for rating credit scores, scores above the high s (on a scale of to ) are generally considered. In conclusion, while a credit score may present certain challenges in the mortgage market, it is by no means a barrier to homeownership. FHA loans offer a. A score is a 'fair' credit score and is considered subprime, which means your credit or loan application may have undesirable conditions that can. No,A good credit score ranges from If you have a score of and above, banks and other NBFC's consider you to be credit healthy. But. Majority of lenders feel credit score of is high risk to issue credit cards and sanction any loans. You may get secured credit card (will be.

A credit score is considered a “fair” score. That means it's higher than a “poor” score yet lower than a “good” one. What does a credit score of mean for my money? · Lenders may be less likely to approve you for credit products. · Even if you are approved for credit, you may. Average credit score · Freddie Mac: Selecting an Indicator Score - " · "A credit score of is the minimum score needed to get the best interest rate for. In general, a credit score above will allow potential mortgage borrowers access to prime or favorable interest rates on their loan. · Scores below are. The average credit score is and most Americans have scores between and , with + considered to be good. Find out more on how you compare. Bad (); Fair (); Good (); Excellent (). Although most credit scores fall between If you've got a credit score of , that means you fall just below the average credit score in Canada. 1. You'll have an easier time renting an apartment According to Experian, a credit score of is often the minimum credit score you need to qualify for an. Improving your credit score to above will enhance your chances for better loans. Understanding how credit scores work is the first step to raising your. FICO considers a score of to as good, while VantageScore rates a score of to as good. FICO boasts that 90% of top lenders rely on their scores. A good credit score is not valid goal. Eliminating your debt is the goal. With an income of K I would pause k now and throw that cash. is the score you'll need for a “very good” credit rating. This is the benchmark score insurers (and some lenders as well) use for mortgage qualifications. credit score falls between and range, that is considered fair. A Credit score is a a below the average score score, get tips on improving. Good credit score (VantageScore: - ; FICO: –). The average VantageScore and FICO credit score for borrowers in the US falls in this range. Lenders. to very good; to good; to fair; and below: poor. Higher credit scores usually mean lower interest rates and more. A credit score between and is needed for a home loan, but a higher A good credit score can help you: You can get approved with more total. This is a poor credit score that is often represented with 2 stars. So, it is ideal to say that there is significant room for improvement. A credit score of is considered excellent and is indicative of a responsible borrower who manages credit and debt well. If you have a credit score of or. If you have a credit score or something in the ballpark, you could be eligible for a personal loan. Offers will be more likely to be returned for borrowers. With a credit score of , most lenders will see you as a higher-risk borrower. You may need a good income, a job, and other debts if you want a loan.

Completely Free Checking Account

The Fortune Recommends TM editorial team ranked more than 35 free checking accounts and curated a list of our top 10 picks. Checking Accounts; Savings Accounts; CDS & IRAS. Swipe or scroll for more information. Checking Account Types, Totally Free Checking Account, Advantage Checking. Totally Free Checking. A free account for everyone! With no minimum balance or monthly service charge after opening your account. no overdraft Fees. Regions Now Checking® Checking account with safeguards to help manage your money and no overdraft fees. $5 monthly fee (can't be waived). Enjoy a totally free checking account with Adventure Credit Union in MI. Access account through online banking and ATMs. Open an account online today. Given the lower financial stressors that credit unions deal with, many of them offer totally free checking accounts to their members with no monthly service. Enjoy Totally Free Checking with Gate City Bank, perfect for all ages – including students! Free ATMs worldwide. No minimum balance. No monthly service fee. Learn about the benefits of a Chase checking account online. Compare Chase checking accounts and select the one that best fits your needs. Open a checking account online and enjoy no fee checking, early payday, and more with Fifth Third Momentum® Checking. The Fortune Recommends TM editorial team ranked more than 35 free checking accounts and curated a list of our top 10 picks. Checking Accounts; Savings Accounts; CDS & IRAS. Swipe or scroll for more information. Checking Account Types, Totally Free Checking Account, Advantage Checking. Totally Free Checking. A free account for everyone! With no minimum balance or monthly service charge after opening your account. no overdraft Fees. Regions Now Checking® Checking account with safeguards to help manage your money and no overdraft fees. $5 monthly fee (can't be waived). Enjoy a totally free checking account with Adventure Credit Union in MI. Access account through online banking and ATMs. Open an account online today. Given the lower financial stressors that credit unions deal with, many of them offer totally free checking accounts to their members with no monthly service. Enjoy Totally Free Checking with Gate City Bank, perfect for all ages – including students! Free ATMs worldwide. No minimum balance. No monthly service fee. Learn about the benefits of a Chase checking account online. Compare Chase checking accounts and select the one that best fits your needs. Open a checking account online and enjoy no fee checking, early payday, and more with Fifth Third Momentum® Checking.

Unlimited ATM fee reimbursements. No overdraft, non-sufficient funds, or monthly maintenance fees. Say goodbye to bank fees for good. Open My Account. A checking solution that's really free. Forget the frills and fees. This account is always charged up and within reach to keep your finances at your fingertips. Best Free Checking Accounts - Editors' Picks ; For International Travel, Capital One Checking Account, No Foreign Transaction Fees ; Student Checking. Digital Federal Credit Union's Free Checking Account has no minimum balance and no monthly maintenance fees. Plus you'll get paid up to 2 days early. With a First Citizens free checking account, you can manage your money anywhere—without a monthly maintenance fee. Open a fee-free online bank account. Everyday checking account that's completely free · No monthly service charge · No minimum balance requirements · Unlimited check writing · Free digital banking. I've had a great experience with Ally if you don't need to visit a physical bank. They don't charge hardly any fees at all, no overdraft fees, no low balance. FREE CHECKING ACCOUNT It's one of the best checking deals around. No minimum balance, no monthly services fees and no hassles. Just simple, convenient. Some things in life are costly and complicated, but Ameris Bank's Free Checking isn't one of them. No monthly service fee. No minimum balance requirements. No Monthly Service Fee. Rest assured your checking account is completely free. All you need is $ to open your account. A FREE account for everyone · No minimum balance · No monthly service charge. Every new personal checking account includes: FREE Debit Card; FREE Online. When choosing a checking account, look for one with low or no fees. Save money by avoiding fees for things like monthly maintenance, ATMs and overdrafts. With a MyFree Checking account, you get a free, online checking account with no minimum balance requirements, maintenance fees or hidden restrictions. Checking Account Features · No monthly fee · No minimum balance · Free first order of checks · Free Online Banking & Bill Pay · Free Debit MasterCard® · Free Bank-by-. Completely Free Checking · No monthly service charge · No minimum balance · Unlimited ATM withdrawals worldwide^ · Free wallet checks for life of account · Free. Youth savers ages may open a Totally Free, Easy Interest, or Preferred Interest Checking account with a parent or guardian. *Up to $10 for checks and. No minimum balance requirement, no monthly service fee, free online banking and bill pay, and the option to add overdraft protection and Check Advance. Compare. Open a checking account with no monthly maintenance fee. Key Smart Checking is a free checking account for everyday needs that puts you in control. When you open an Asterisk-Free Checking account, you don't have to worry about paying a maintenance fee each month. Free to Open. We don't charge you a fee to. The Free Checking Account is our basic checking account Zelle® and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein.

Chapter 7 Or Chapter 11

Chapter 11 bankruptcy is a reorganization bankruptcy usually filed by businesses. In contrast to chapter 7, the debtor remains in control of business operations. The biggest difference between Chapter 7 and Chapter 13 is that Chapter 7 focuses on discharging (getting rid of) unsecured debt such as credit cards, personal. Chapter 11 is a type of bankruptcy generally filed by businesses and involves a reorganization of their assets and debts under court supervision. When a hospital or any other business files for Chapter 11 bankruptcy, it enters into a reorganization process. This process allows the business to develop a. This chapter of the Bankruptcy Code provides for "liquidation" - the sale of a debtor's nonexempt property and the distribution of the proceeds to creditors. The court sells all your assets (except exempt assets) and then pays your creditors. Chapter 7 and Chapter 13 mostly affect consumers. Chapter 11 is usually for. Chapters 7, 11, 13 don't apply to Canadians. Contact the OSB for more information and help with distinguishing which laws apply to you as a Canadian. For individuals, there are two main types of bankruptcies that can be filed: Chapter 7 bankruptcy and Chapter 13 bankruptcy. Under chapter 7, a trustee administers the debtor's assets to satisfy creditors' claims. By contrast, chapter 11 reflects Congress' view that “current. Chapter 11 bankruptcy is a reorganization bankruptcy usually filed by businesses. In contrast to chapter 7, the debtor remains in control of business operations. The biggest difference between Chapter 7 and Chapter 13 is that Chapter 7 focuses on discharging (getting rid of) unsecured debt such as credit cards, personal. Chapter 11 is a type of bankruptcy generally filed by businesses and involves a reorganization of their assets and debts under court supervision. When a hospital or any other business files for Chapter 11 bankruptcy, it enters into a reorganization process. This process allows the business to develop a. This chapter of the Bankruptcy Code provides for "liquidation" - the sale of a debtor's nonexempt property and the distribution of the proceeds to creditors. The court sells all your assets (except exempt assets) and then pays your creditors. Chapter 7 and Chapter 13 mostly affect consumers. Chapter 11 is usually for. Chapters 7, 11, 13 don't apply to Canadians. Contact the OSB for more information and help with distinguishing which laws apply to you as a Canadian. For individuals, there are two main types of bankruptcies that can be filed: Chapter 7 bankruptcy and Chapter 13 bankruptcy. Under chapter 7, a trustee administers the debtor's assets to satisfy creditors' claims. By contrast, chapter 11 reflects Congress' view that “current.

Chapter 11 lets people who don't qualify for Chapter 13 or need some of the special protections that Chapter 11 provides reorganize their debt. When filing Chapter 7 bankruptcy, you can keep most of your assets and the process takes about months. Chapter 11 bankruptcies are filed usually by large. bankruptcy. (see Wisconsin Chapter 7 Bankruptcy or Wisconsin Chapter 13 Bankruptcy? and Wisconsin Non-Dischargeable Debts). Back to Top. What Will Happen. This chapter of the Bankruptcy Code generally provides for reorganization, usually involving a corporation or partnership. In contrast, Chapter 7 governs the process of a liquidation bankruptcy, though liquidation may also occur under Chapter 11; while Chapter 13 provides a. Chapter 7 is the least complicated of the various bankruptcy programs. It's designed for low-income individuals or people with severely upside-down finances. Only about 10% of Chapter 11 filings result in success; far more often, they end up in Chapter 7 straight bankruptcy, in which the company closes and its assets. Chapter 7 and 13 bankruptcy are designed for individuals, while chapter 11 is typically for businesses. Learn about each and which fits your case. If you're a small business owner, you'll want to understand how each bankruptcy chapter will affect your company. Find out how Chapter 7 or Chapter Bankruptcy (Chapter 7 or Chapter 11); Bankruptcy (Chapter 13); Multiple Bankruptcy Filings; Foreclosure; Foreclosure and Bankruptcy on the Same Mortgage; Deed-. Chapter 7: This is a liquidation bankruptcy, sometimes called “straight bankruptcy”. The principle advantage is that the debtor comes out without any future. Businesses generally file for chapter 7 liquidation when there is no possibility of achieving profitability under a chapter 11 reorganization. A chapter 7. Partnerships and corporations file bankruptcy under Chapter 7 or Chapter 11 of the bankruptcy code. Individuals may also file under Chapter 7 or Chapter Q: Who can file under Chapter 11 of the Bankruptcy Code? A: Anyone who can file under Chapter 7 can file under Chapter 11 with the exception of a stockbroker or. Chapter 7 bankruptcy is often more attractive than Chapter 13 because it's simpler and gets you on the road to financial stability sooner. Most Chapter 7 cases. Chapter 7 is the most common form of bankruptcy for individuals. · Chapter 11 bankruptcy is usually for corporations because of its complexity, but individuals. Chapter 7 and Chapter 13 are personal bankruptcies that serve individuals who have a lot of medical, credit card, or other consumer debt. Chapters 9, 11, Individuals must use Chapter 11 when their debts exceed Chapter 13 debt limits. It rarely makes sense in other instances but has more options for lien stripping. The filing of a Chapter 7 or Chapter 11 bankruptcy case by an employer can have devastating consequences for its employees. It can mean not only the loss of. Chapter 11 is the chapter of the Bankruptcy Code that permits a person or business to reorganize while obtaining protection from its creditors.

New York Commodity Exchange

New York Mercantile Exchange (NYMEX) Price Charts and Quotes for Futures, Commodities, Stocks, Equities, Foreign Exchange - happygamestation.ru Markets. The New York Mercantile Exchange (NYMEX), the largest physical commodity natural gas futures exchange in the world is a part of the Chicago Mercantile Exchange. The New York Mercantile Exchange (NYMEX) is the world's largest physical commodity futures exchange and a part of the Chicago Mercantile Exchange Group. Trading Commission, Securities and Exchange Commission, and Department of the Self-Regulatory Organizations; New York Stock Exchange. market data services offer members new opportunities to improve their trading strategies. MIAX operates fully electronic exchanges built on award-winning. Commodity Exchange Authority and Commodity Exchange Commission consolidated to form CFTC, New York). Contract market designations, Kansas City regional. New York Mercantile Exchange Inc. operates a derivatives exchange. The Exchange offers trading of futures contracts, swaps, and option contracts on. New York Commodities Exchange (COMEX). Share. Advertisement. The New York Commodities Exchange (COMEX) is a major center of trade in commodities derivatives. A commodity exchange in New York that specializes in trading in metal futures contracts and options. Founded in , it became a division of the New York. New York Mercantile Exchange (NYMEX) Price Charts and Quotes for Futures, Commodities, Stocks, Equities, Foreign Exchange - happygamestation.ru Markets. The New York Mercantile Exchange (NYMEX), the largest physical commodity natural gas futures exchange in the world is a part of the Chicago Mercantile Exchange. The New York Mercantile Exchange (NYMEX) is the world's largest physical commodity futures exchange and a part of the Chicago Mercantile Exchange Group. Trading Commission, Securities and Exchange Commission, and Department of the Self-Regulatory Organizations; New York Stock Exchange. market data services offer members new opportunities to improve their trading strategies. MIAX operates fully electronic exchanges built on award-winning. Commodity Exchange Authority and Commodity Exchange Commission consolidated to form CFTC, New York). Contract market designations, Kansas City regional. New York Mercantile Exchange Inc. operates a derivatives exchange. The Exchange offers trading of futures contracts, swaps, and option contracts on. New York Commodities Exchange (COMEX). Share. Advertisement. The New York Commodities Exchange (COMEX) is a major center of trade in commodities derivatives. A commodity exchange in New York that specializes in trading in metal futures contracts and options. Founded in , it became a division of the New York.

The New York Produce Exchange was a commodities exchange headquartered in the Financial District of Lower Manhattan in New York City. It served a network of. New York Mercantile Exchange, Inc. ("NYMEX") and Commodity Exchange, Inc. ("COMEX") are not related to The NASDAQ Stock Market ("NASDAQ"). At least three commodity exchanges cancelled their morning trading sessions. the New York/Tokyo/London Commodity Exchange. See also. commodity market. Two of the best-known commodity exchanges in the U.S. are the Chicago Mercantile Exchange Group and the New York Mercantile Exchange. Traders rarely take. The New York Mercantile Exchange (NYMEX) is a commodity futures exchange located in Manhattan, New York City. It is owned by CME Group, one of the largest. Natural gas futures allow you to trade a benchmark commodity. Find out more New York Mercantile Exchange (NYMEX), Henry Hub Natural Gas Futures, /NG. We are an institutional-grade financial services franchise that provides global market access, clearing and execution, trading platforms and more. COMEX is an abbreviation for The Commodity Exchange. · The Commodity Exchange is the main exchange for silver and gold futures. · The exchange operates out of the. The New York Mercantile Exchange is the only US “contract market” which is authorised to trade crude oil and oil products contracts. The CEA's precise scope has. Today's top Commodity Trading jobs in New York, United States. Leverage your professional network, and get hired. New Commodity Trading jobs added. – The Commodity Exchange (COMEX) is founded from the merger of the National Metal Exchange, the Rubber Exchange of New York, the National Raw Silk Exchange. trading futures or option contracts based on all types of commodities. Established in as the New York Cotton Exchange Association, ICE Clear. Latest News. Aug. Press Release: CFTC Staff Issues No-Action Letter Comments submitted to the Commission are available online for public review. New York Futures Exchange offers a futures contract based on the New York Stock Exchange Index. Moreover, the Chicago Board of Trade, over the objection of. Commodity Exchange Inc, operates as a commodity futures exchange. The Company ADDRESS. Vesey Street New York, NY United States. WEBSITE. www. Official daily closing prices at p.m. from the trading floor of the New York Mercantile Exchange (NYMEX) for a specific delivery month. The natural gas. The scope of its regulations make basic knowledge of the governing statute, the Commodity Exchange Act, essential for both lawyers with established practices in. - SECURITIES AND COMMODITIES MARKET SERVICES, (INCLUDING DIREC. No. - SMARTCARDS, LIMITED AND STANDARD USE PROXIMITY INTEGRATED CI. No. The Commodity Exchange, better known as COMEX, is a division of the New York Mercantile Exchange that trades futures in metals such as gold, silver. Mercantile Exchange), CBOT (Chicago Board of Trade), NYMEX (New York Mercantile Exchange), and COMEX (Commodity Exchange, Inc.). By daily volume the CME is.

How Much Does It Cost For Luggage On A Plane

Want to save on checked bag fees? Save $10 each on your first 2 checked bags ($5 each on transatlantic flights) when you add them before check-in (at least. Prices for additional baggage ; €26/$29/£23 up to €57/$63/£49 ; €/$/£85 to €/$/£ A $30 fee applies for checked bags over 50 lbs / 23 kgs up to 53 lbs / 24 kgs. There is no change to overweight fees for travel on / before April 16, Checked baggage fees. Would you like to add a checked baggage or a second or third bag? The fare will depend on how far in advance you make. There is a fee for any additional pieces of checked baggage. Do you have a connecting flight? When several airlines are involved in a flight. Are there fees for baggage on American Airlines (AA)? ; US domestic (including Canada, Hawaii, Puerto Rico, and US Virgin Islands: · Second bag: $ USD. With American Airlines, when you check baggage at the airport weighing up to 50lbs and measuring 62′′ (L+W+H) or less, you will pay $$ Quickly find information about fees for baggage, meals, unaccompanied minor service, and seating assignments across all airlines by using the search bar below. BAGGAGE FEES. Checked bag 20 kg (44 lbs). CAD. Checked bag 23 kg (50 lbs). CAD. Checked bag 32 kg (70 lbs). CAD. Carry-on bag + Priority Boarding. Want to save on checked bag fees? Save $10 each on your first 2 checked bags ($5 each on transatlantic flights) when you add them before check-in (at least. Prices for additional baggage ; €26/$29/£23 up to €57/$63/£49 ; €/$/£85 to €/$/£ A $30 fee applies for checked bags over 50 lbs / 23 kgs up to 53 lbs / 24 kgs. There is no change to overweight fees for travel on / before April 16, Checked baggage fees. Would you like to add a checked baggage or a second or third bag? The fare will depend on how far in advance you make. There is a fee for any additional pieces of checked baggage. Do you have a connecting flight? When several airlines are involved in a flight. Are there fees for baggage on American Airlines (AA)? ; US domestic (including Canada, Hawaii, Puerto Rico, and US Virgin Islands: · Second bag: $ USD. With American Airlines, when you check baggage at the airport weighing up to 50lbs and measuring 62′′ (L+W+H) or less, you will pay $$ Quickly find information about fees for baggage, meals, unaccompanied minor service, and seating assignments across all airlines by using the search bar below. BAGGAGE FEES. Checked bag 20 kg (44 lbs). CAD. Checked bag 23 kg (50 lbs). CAD. Checked bag 32 kg (70 lbs). CAD. Carry-on bag + Priority Boarding.

Otherwise, if you choose to bring a carry-on bag and/or checked luggage, fees apply. Prices at the airport are higher. Visit Manage Travel to reserve your bags. Buy Bags Now & Save Later · The cheapest time to buy is at initial booking! See Pricing · Size: 24"H X 16"W X 10"D and. There is a fee for any additional pieces of checked baggage. Do you have a connecting flight? When several airlines are involved in a flight. Prices for additional baggage ; €26/$29/£23 up to €57/$63/£49 ; €/$/£85 to €/$/£ Checked baggage basics · Up to 50 pounds each · 62 inches in size (length + width + height) · Three+ Bags: $ per bag · Oversize Bag: $ per bag (max 80 inches). 2nd bag: CA/US $ View our complete checked baggage policy for details. We have detected a device type and/or operating system version that may result in. USD (These items are not included in the Free Baggage Allowance.) ; USD (These items are not included in the Free Baggage Allowance.). Travel to / from Canada, Caribbean, Mexico, Central America, and Guyana – 1st checked bag fee is $35 and the 2nd checked bag fee is $ All bag fees are non-. Overweight and oversize bags (in addition to the original bag price) are $ For bookings made on/before 10/02/ overweight and oversize bags are $20 (51 to. Over 23kg(50lbs) in economy class/or over 28kg(61lbs) in premium economy class but under 32kg(70lbs): pieces of excess baggage charge rate should be. Depending on where and how you travel, you may have to pay to check your bag. Use our baggage fee calculator to see how much it'll cost. Calculate bag fees. 2nd bag: $ Comfort and Flex fares: 1st bag: free; 2nd bag: $ Latitude fares: 2 bags free. Note: Prices are before any applicable taxes. Basic and. Are there fees for baggage on United Airlines (UA)? · First bag: $ USD · Second bag: $ USD · Third and any additional: $ USD per bag. Did you know that Southwest Airlines® does not charge for your first or second checked bag? That's right! While bag fees have become the norm amongst our. fees associated with checked luggage How much does it cost to check a bag with Avelo Airlines? Please visit the. The table below shows how much members and non-members pay for Airlines, Hawaiian Airlines baggage fees and rules would apply both ways. See exact prices for extra checked baggage. Baggage allowance for does not include checked baggage. Read more about travelling with children. If your journey involves multiple flight segments operated by more than one carrier, then other carrier's baggage fee policy may apply. Excess Baggage Fee Chart. Baggage Charges · How much do you charge to check-in a musical instrument? · How do I retrieve a baggage receipt? How Much Does it Cost to Check a Bag? The budget-savvy traveler may use a Many airlines allow larger or heavier bags for their first-class and.

Small Business How To Accept Credit Card Payments

Eligible Small Businesses can accept through your provider, which sets the rate for card acceptance. Plus receive a single statement and deposit, the same way. Accepting online credit card payments with PayPal Paypal was one of the first companies to allow businesses to accept credit card payments without a merchant. There are only two requirements to begin accepting credit card payments: a merchant service provider (MSP) or a credit card processing service and a collection. If your business has its own website, it may be able to accept online payments if the website includes an online payment gateway. This form of payment is. Partnering with a payment processor such as Payment Depot will allow your small business to securely accept your customer's credit card payments. Adding credit cards as a preferred method of payment can help boost your business revenue, but you need a way to manage all that cash flow. Look no further than. Credit card processing services come in many forms, from simple payment terminals to complete point-of-sale (POS) systems. It's crucial for small business. Your bank is an important business partner in helping you manage your receivables, including credit card payments. You don't need to sweat the technical and. Benefits of accepting Debit, Credit & Gift Cards · Convenient Offer customers choice and flexibility and let them pay the way they want – in store or on the go. Eligible Small Businesses can accept through your provider, which sets the rate for card acceptance. Plus receive a single statement and deposit, the same way. Accepting online credit card payments with PayPal Paypal was one of the first companies to allow businesses to accept credit card payments without a merchant. There are only two requirements to begin accepting credit card payments: a merchant service provider (MSP) or a credit card processing service and a collection. If your business has its own website, it may be able to accept online payments if the website includes an online payment gateway. This form of payment is. Partnering with a payment processor such as Payment Depot will allow your small business to securely accept your customer's credit card payments. Adding credit cards as a preferred method of payment can help boost your business revenue, but you need a way to manage all that cash flow. Look no further than. Credit card processing services come in many forms, from simple payment terminals to complete point-of-sale (POS) systems. It's crucial for small business. Your bank is an important business partner in helping you manage your receivables, including credit card payments. You don't need to sweat the technical and. Benefits of accepting Debit, Credit & Gift Cards · Convenient Offer customers choice and flexibility and let them pay the way they want – in store or on the go.

But for small business owners, it's not always obvious what accepting credit and debit card payments will mean for their businesses. Many small business owners. QuickAccept is a built-in credit card processing feature of Chase Business Complete Banking that lets you accept payments anywhere in the U.S. 1. Create a shortlist of payment processors likely to approve you. · 2. Determine the best payment structure for your business. · 3. Determine your hardware and. To accept credit cards, you need three things: a credit card merchant account, a bank account and a way to process payments. A merchant account allows your. Find a Credit Card Processing Provider for Your Small Business · Open a Merchant Account · Set Up Payment Terminals · Beware and Pay Attention To Credit Card. Accept Visa card payments in-store To start accepting Visa cards find a payment provider licensed by Visa, and set up an appointment to discuss a merchant. If you're a new business, Square offers an affordable and immediate way to accept credit card payments in-person through Square's POS app, online through Square. If your business has its own website, it may be able to accept online payments if the website includes an online payment gateway. This form of payment is. Keen to be able to take online payments? Your business can accept online credit card payments in two ways – through your own online business or a third-party. Interchange-plus may be the best option for your business. Industry experts recommend interchange-plus pricing because it's more transparent than the other. You would be a vendor. There's an approval process. Stripe and PayPal are the easiest to get going and get that card reader in the mail. To take in-person credit card payments, begin by selecting an appropriate point-of-sale (POS) system or device and setting up a merchant account through your. Merchant Account + Payment Gateway · All-in-One Solutions · Credit Card Payment Processing, Simplified · 10 Questions All Businesses Should Ask a Payment Provider. PayPal: PayPal is a very popular online payment processing service used by corporations and small businesses alike. For in-person payments, they offer % per. Providers like PayPal, 2Checkout, or Braintree offer easy-to-implement payment gateways with competitive transaction fees. Stax also offers a range of payment. What Steps Do You Need To Follow To Accept Credit Card Payments? · 1. Determine How You Will Accept Credit Card Payments. · 2. Select A Credit Card Payment. Accept Visa card payments in-store To start accepting Visa cards find a payment provider licensed by Visa, and set up an appointment to discuss a merchant. 3. Acquiring Bank. The merchant bank that allows the business to receive money from card transactions and store these funds. Sometimes acquiring banks may also. You can use a payment processing app on your phone to accept credit cards at your mobile business or on the go without your POS. This option is great for.

Nadex Signals

Live signals are quickly becoming the game changer in the Forex and Nadex Binary Options trading markets. Live signals provide traders with. Technical Indicators: Despite the bullish signals, exercise caution for potential overextension. ○ Outlook: Traders should remain vigilant for signs of. I highly recommend Trusted Markets Binary Options Signals, best signal service but it's expensive because you paying $ monthly for the. Followers, Following, Posts - signals for nadex (@usbinaryopsignals) on Instagram: "#nadex #binaryoptions #futurestrading #stockmarket #forex". How many signals will I receive each market day? The software monitors 9 currency pairs (Assets) and provides real time signals whenever Nadex has matching. Nadex Signals Daily · Signals found on this page are for the NADEX trading platform. · Signals are chosen carefully. · Signals are posted once per day, at. The Dexie Indicator is a complete Forex trading system built for the 5 min chart. It is suitable for Nadex users and provides BUY/SELL signals with alerts and. Most binary option platforms provide only one choice: will the market go higher or lower in the next five minutes. Nadex has various contract durations: Specifically, members should review Nadex Rule (d) which states “ a Trading Member may not knowingly or negligently permit any Person not authorized by Nadex. Live signals are quickly becoming the game changer in the Forex and Nadex Binary Options trading markets. Live signals provide traders with. Technical Indicators: Despite the bullish signals, exercise caution for potential overextension. ○ Outlook: Traders should remain vigilant for signs of. I highly recommend Trusted Markets Binary Options Signals, best signal service but it's expensive because you paying $ monthly for the. Followers, Following, Posts - signals for nadex (@usbinaryopsignals) on Instagram: "#nadex #binaryoptions #futurestrading #stockmarket #forex". How many signals will I receive each market day? The software monitors 9 currency pairs (Assets) and provides real time signals whenever Nadex has matching. Nadex Signals Daily · Signals found on this page are for the NADEX trading platform. · Signals are chosen carefully. · Signals are posted once per day, at. The Dexie Indicator is a complete Forex trading system built for the 5 min chart. It is suitable for Nadex users and provides BUY/SELL signals with alerts and. Most binary option platforms provide only one choice: will the market go higher or lower in the next five minutes. Nadex has various contract durations: Specifically, members should review Nadex Rule (d) which states “ a Trading Member may not knowingly or negligently permit any Person not authorized by Nadex.

What is binary options technical analysis? · Trend – these show market direction. · Momentum – momentum indicators show how strong a trend is and signal where. Hello Everyone! I am providing nadex signals in which you guys can make $ or more in a span of 2hrs. The investment you have to do is. Nadex daily signals employ a combination of technical analysis indicators and market sentiment analysis to make their trading decisions. They use indicators. Be More Laid Back in Trading NADEX Weekly Spreads OWP System E FX for Better Success - BEST Trading Signals. You should carefully consider whether trading on Nadex is appropriate for you in light of your investment experience and financial resources. Any trading. Binary Options Signals Nadex – Low Deposit Broker Platform or traders that open support levels; maybe. Fall, and find lucrative, time is had, then, investors. Signal service for 5m expiry trades. Focus on Asian session 1 trade a day. Min requirement $ Automate your trading with Pocket Option Copy Trading. Set. New Post: NADEX Swing Trading Signals with OWP System E-FX – Forex Signals and Forex NADEX Signals happygamestation.ru Mobile App – NadexGo. Signals service – No. Nadex offer their clients the following features and benefits: Transparent trading costs – Nadex are clear about how. Signal Interpretation: The robot deciphers complex trading signals from TradingView with precision, ensuring it makes informed trading decisions on your behalf. Membership Obligations related to Automated Trading As a reminder, Nadex does not create, disseminate or auto-execute trading signals or recommendat View. NADEX Auto Signals Unfortunately, NADEX does not offer a way to trade automatically. For more auto trading products – visit our Robots Page. NADEX is among. What sets our NADEX Signals apart is our unparalleled accuracy. We pride ourselves on delivering signals with a high success rate, giving you the confidence to. Signals Dashboard. Nadex Binary Signal (BUY): US | Contract: () Offer: @80 Or Better Rate, For Expire At PM APR | Recommended SL When. Nadex Free Signals. 67 likes. This group is a one week free trial for help with Nadex Binary Options through happygamestation.ru, I post advi. The service is designed for smaller trading accounts and focuses on trading good momentum stocks with the potential for profit. It provides trading signal. Nadex Signals are full so they are not available as part of the program any Nadex Binaries in a way I have literally not taught ANY single trader. This is a paid signal group we call out very high quality nadex signals for you to take on your nadex account the membership fee to join is very. Contact: happygamestation.ru Background: We recently became aware of the website of Nadex Pro Signals, an entity that purports to be based in.

What Should I Invest 5k Into

So you want to dip your toe into investing but you're not sure where to start? The world of investments can seem daunting to newcomers, with baffling jargon. What is a Fiduciary? How to Invest $k · What's a Good P/E Ratio? Types of to have ready access to should be saved somewhere else. Secondly. 1. Invest in Government Bonds, Corporate Bonds, and Certificates of Deposit (CD's). (Low risk level) · 2. Invest in commodities (gold, silver. Diversify your investments to spread your risk One of the best ways to reduce your risks with the money you're investing is to not put your eggs all in one. How to Invest in ETFs Another option for starting small is an ETF, most of which require no minimum investment. Unlike most mutual funds, ETFs typically have. Use our calculator to see how the value of an investment could change under different market conditions. Enter how much you'd like to start investing with. Kenneth Chavis IV, CFP and senior wealth manager at LourdMurray, suggests money market funds “for those who are not comfortable with investment risk but want to. Starting with 5k, if you are going for income I'd say, buy 1 bank stock, and with the remaining capital, buy REITs and companies that grow their dividends year. “Best” for me was the stock market. Stocks can be a lucrative investment if you do your homework or have good advice. So you want to dip your toe into investing but you're not sure where to start? The world of investments can seem daunting to newcomers, with baffling jargon. What is a Fiduciary? How to Invest $k · What's a Good P/E Ratio? Types of to have ready access to should be saved somewhere else. Secondly. 1. Invest in Government Bonds, Corporate Bonds, and Certificates of Deposit (CD's). (Low risk level) · 2. Invest in commodities (gold, silver. Diversify your investments to spread your risk One of the best ways to reduce your risks with the money you're investing is to not put your eggs all in one. How to Invest in ETFs Another option for starting small is an ETF, most of which require no minimum investment. Unlike most mutual funds, ETFs typically have. Use our calculator to see how the value of an investment could change under different market conditions. Enter how much you'd like to start investing with. Kenneth Chavis IV, CFP and senior wealth manager at LourdMurray, suggests money market funds “for those who are not comfortable with investment risk but want to. Starting with 5k, if you are going for income I'd say, buy 1 bank stock, and with the remaining capital, buy REITs and companies that grow their dividends year. “Best” for me was the stock market. Stocks can be a lucrative investment if you do your homework or have good advice.

As for increasing your SIP amount, evaluate your capacity to invest more based on your income, expenses, and other financial commitments. If you have surplus. What's the best way to invest money? · Pensions · Stocks and shares ISAs · Platform investing · Share dealing · Asset investments · Property. I have 5k that I want to use to start investing in real estate. How would you seasoned investors recommend I start? I already know that I could save m. Exchange-traded funds (ETFs) and mutual funds. Both ETFs and mutual funds offer a basket of securities (such as stocks and bonds) inside one investment. You. How to Invest in ETFs Another option for starting small is an ETF, most of which require no minimum investment. Unlike most mutual funds, ETFs typically have. Kenneth Chavis IV, CFP and senior wealth manager at LourdMurray, suggests money market funds “for those who are not comfortable with investment risk but want to. Another popular investment type is real estate. A popular form of investment in real estate is to buy houses or apartments. The owner can then choose to sell. What Is The Best Investment Plan With Rs. 5, Only · 1. Systematic Investment Plan (SIP) · 2. Recurring Deposit (RD) · 3. Exchange Traded Funds . So you want to dip your toe into investing but you're not sure where to start? The world of investments can seem daunting to newcomers, with baffling jargon. Start your investing journey · Do it yourself. Illustration of a compass and map. Create and monitor a portfolio and get help any time you need it. Invest on. Investing your money in an index or mutual fund may be the better option. Index funds, such as those by Vanguard, don't try to beat the market and instead buy a. Our robo-advisor does the work, so you don't have to. · Automated investing with human help when you need it. · Backed by our commitment to keeping costs low. For short-term goals — such as a pending home or car purchase or setting up an emergency savings account — you generally want to save, not invest. So having. Use our calculator to see how the value of an investment could change under different market conditions. Enter how much you'd like to start investing with. You can invest in an ETF for less than $, while mutual funds often ask you to invest at least $1, A share of stock can range in price from a few dollars. Learn how saving for retirement should fit into your other priorities. How All investing is subject to risk, including the possible loss of the money you. Equity-oriented Mutual Funds are the best investment options with high returns that allow multiple investors to pool money and invest in a diversified portfolio. Technically this isn't investing, but money market accounts are really great for short-term savings goals (as in five years or less). MMAs are very similar to. Although saving for your future is critical, so is investing in your future. Choosing not to invest could mean failing to financially live the life you want or. On the other hand, investing in the stock market presents you with several options. While you can directly invest and manage your stocks, you may also opt to.